In June 2019 Martin Zeilinger and Furtherfield held a Future of Money workshop, inviting people with expertise in alternative currencies, crypto tech and to meet with sci-fi writers and enthusiasts. They presented their work and to stimulate a discussion on how the politics and practicalities of cashlessness could be explored with younger generations.

Contributors included:

Mud Howard – gender non-comforming sci-fi writer; Arjun Harrison-Mann – graphic designer; Ben Cain – graphic designer; Brett Scott – on the future of money; Jaya Klara Brekke – on the politics of crypto finance; Ailie Rutherford – feminist economics artist; Peter Holsgrove – art and blockchain developer; Cecila Wee – writer and curator with finance and money specialism. The aim of this event was to develop a framework for running workshops exploring the issues of a cashless society.

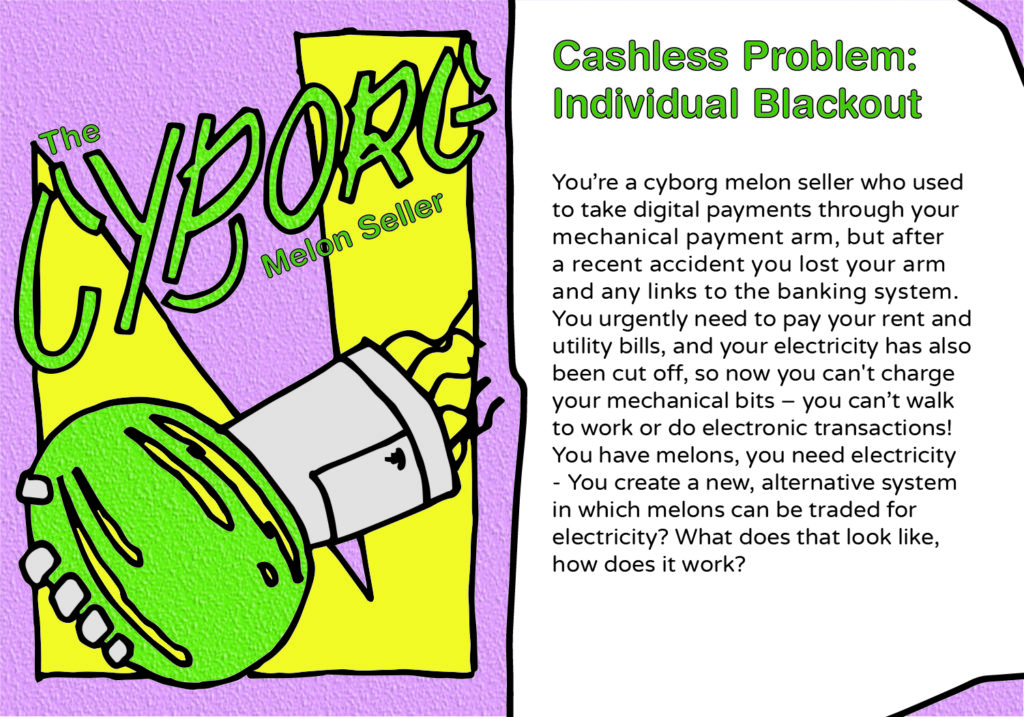

The framework, devised by Zeilinger, Furtherfield and Studio Hyte, is a playful workbook (and set of stickers and badges). Users select a scenario from Planet Cashless 2029 and are invited through a set of steps designed to tease out solutions to the scenario. For example in one scenario a cyborg melon seller loses power in their digital payment arm and they need to find an alternative way to sell their melons!

We now plan to further bring the workbook alive with AR. In particular, we aim to create futuristic scavenger hunts where young people can explore locally, investigate financial forms for themselves, and come up with their own solutions to arising issues of the disappearance of cash.

The first Future of Money Lab was run by Zeilinger and Catlow at Furtherfield Commons, London, on 6th June 2019

Martin Zeilinger is a new media researcher, curator, and practitioner whose work focuses on the intersections between new media art, emerging technologies, critical theory, and activism in the financial, political, and environmental realms. Martin is Senior Lecturer in Computational Arts & Technology at Abertay University in Dundee. He has curated the Toronto-based Vector New Media Arts Festival since 2013, and is a member of the curatorial collective for the Dundee-based NEoN Festival.

Featured image: Image from Planet Cashless 2029 booklet designed by Studio Hyte

When I first heard about MoneyLab, it was back in 2013 or the beginning of 2014, when I was doing my masters in London. A friend of mine handed a flyer to me and I was intrigued by the strange typography and the combination of bright colours. However, I didn’t quite believe that any kind of initiative could really start an alt-economy movement. Not that I didn’t believe in local currency or creative commons, but those gentle approaches generally seemed to lack traction, just like liberals do with voters. I naturally thought MoneyLab was one of those initiatives.

However, as Bitcoin was becoming a hype, the name popped up again; MoneyLab itself was also becoming a hype. While bitterly regretting not being able to be associated as the first wave of participants, I started to think that maybe MoneyLab might be the framework that can really push out alternative economic attempts as mainstream culture. My stance towards economic shifts was somewhat similar to that of William Gibson’s; he said in an interview with the British newspaper The Guardian, ‘What would my superpower be? Redistribution of wealth’. How did that change after reading the MoneyLab Reader 2?

Before going into the details of what blockchain technology can really do, it is crucial to understand a new “unit of value” created in modern society (Pine and Gilmore 1999). Since the most prominent piece of technology of our era is undoubtedly smartphones (with Apple being the first 1 trillion dollar publicly listed company in the US), a lot of transactions are inevitably conducted through apps and web services. The proliferation of the so-called “payments space” signifies the era of UX design, which is the third paradigm of HCI (Human-Computer Interaction), “tak[ing] into account…affect, embodiment, situated meaning, values and social issues” (Tkacz and Velasco 2018). In other words, experience has become the deciding factor of customers’ choices. With vast amounts of data generated at the back of sleek interfaces, one can precisely oversee the users’ behaviour, which then is fed back into the system.

All the payments spaces are essentially digital. This means transactions leave digital traces whether you like it or not. The idea of a cashless society exactly stems from this interest, the authorities can have better understandings of how people make money; in other words, where black money flows. Brett Scott has been pointing out the danger of a cashless society for quite some time now, I saw another variation in this book.

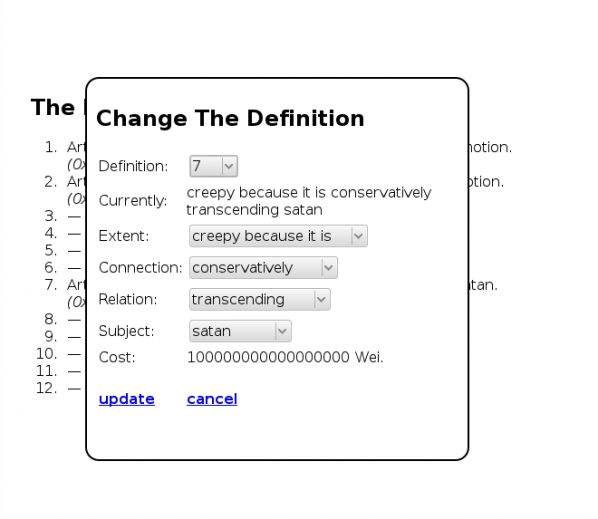

According to Jaya Klara Brekke, blockchain technology can make money programmable, “allow[ing] for very fine-grained (re)programming of the medium of money, from what constitutes, and how to measure, value-generating activity to the setting of parameters on the means and conditions of exchange – what is spendable, where and by whom” (Brekke 2018). The overall impression I got from the MoneyLab Reader 2 about what blockchain technology can really do is basically this. Making a currency programmable using smart contracts.

More than a couple of authors discuss how “contingency” should take place in designed currencies. Contingency is different from randomness; in fact, it could mean exactly the opposite. For example, when coins are distributed in a perfectly random manner, you have absolutely no control in the handling process. If contingency is embedded in a system, it means there are exploitable gaps, which seem to almost randomly benefit people. On the other hand, some individuals would find ways to make use of these gaps, which are considered to be legitimate. Brekke discusses how the way in which contingency is programmed into a currency will be a key for the future of finance, both in terms of experience and redistribution of wealth. Therefore, currency designers will be the next UX designers.

A number of ideas applying blockchain technology to both physical and cultural objects are mentioned in this book, from a self-maintaining forest to blockchain-based marriage. “Terra0” is the concept of an autonomous forest which can “self-harvest its own value” (Lotti 2018). Utopian views of a human-less world are prevalent, but in reality, a healthy forest requires an adequate amount of human intervention. In addition, the value of a forest cannot be determined by itself; trade routes, demand and supply, they are all drawn by human movements. For example in Japan, domestic wood resources are generally not profitable because of the expensive labour costs. Illegally cut trees without certification from Southeast Asia dominate the market, putting domestic ones in a bad position. When a forest itself is not profitable, how can it accumulate capital autonomously? Besides, the oracle problem has not been discussed at all. Unless everything is digital in the first place, there always needs to be somebody to put data onto the blockchain. In other words, the transcendence of the boundaries between the physical and the digital is not possible without human intervention. Blockchain marriage would face a similar problem; who might be the witness if circumventing the government official? Max Dovey investigates the notion of “crypto-sovereignty” while introducing an example of a real blockchain marriage where they “turn[ed] ‘proof of work’… into ‘proof of love’”(Dovey 2018). Just as the sacramental bond between spouses can be broken before Death Do Them Part, so can any cryptographic marriage unravel despite having been recorded in an immutable ledger. Whatever repercussions may exist for divorce, there are no holy or technological mechanisms to prevent it.

Platform co-ops is one of the largest topics in the book besides Universal Basic Income (UBI). A platform co-op is often a cooperatively owned version of a major platform that is supposed to be able to pay better fees to the workers. Also, a platform co-op is often associated with “lower failure rate”; 80% of them survive the first five years when only 41% of other business models do (Scholz 2018). While embracing the positive aspects of platform co-ops, I have this question stuck in my head: can you not make a platform co-op based on a new idea rather than copying existing ones?

Most platform co-ops seem that they are looking at already successful and established concepts such as rental marketplaces for rooms and ride hailing services. As a result, platform co-ops are considered more to be a social movement than an innovation. Why not just run a business right at the centre of Capitalism without being motivated by profit? Many platform co-ops challenge the main stream services such as Airbnb or Uber, however those services operate based on scale; if they have the largest user base, it will be very difficult to take them on, unless they die themselves like Myspace… Moreover, more hardware side of development can be happening around co-ops, but I don’t hear anything except for Fairphone. When can I stop using my ThinkPad with Linux on it?

After reading the MoneyLab Reader 2: Overcoming the Hype, now I’m thinking of how I should design my own currency. Of course whether cryptocurrencies are actually currencies is up to debate; depending on who you ask, Ethereum is a security (SEC), a commodity (CFTC), taxable property (IRS) or a currency (traders).

MoneyLab 2 authors overall suggest that we should not limit our imagination to fit in the existing finance systems, but think beyond. You don’t necessarily need to cling to cryptocurrencies but they may help you shape your ideal financial system.

10:30 – 14:00 – Ruth Catlow and Max Dovey

Artists Organise (on the blockchain) is the fourth event in the DAOWO blockchain laboratory and debate series for reinventing the arts.

In previous workshops, hosted by Goethe Institut London, we have explored developments in the arts ecosystem, impacts on identity, and the complex considerations involved in formalising systems for “doing good” on the blockchain.

In this special event hosted by Drugo More in Rijeka we will draw on the Croatian cultural context and attempt to envision, devise and test alternative forms of blockchain-based cultural production systems, for application at Furtherfield in London. This workshop is part of a wider programme events in Rijeka to accompany the opening at Filodrammatica Gallery of the touring exhibition New World Order.

Set up in 2002, the pioneering non-profit Croatian initiative Clubture“aims to empower the independent cultural sector”, organising according to decentralised, participatory principles that resonate with claims made for blockchain governance.

Together we will explore what lessons can be learned from the radical, decentralized, participatory organising principles developed by both Furtherfield and Clubture, when assessing the potential value of blockchain technologies to instigate collaboration between networks of cultural players? How do the affordances of different blockchain value systems impinge on our ideas of human nature, and the value and limitations of existing cultural institutions and networks? Who are the networks’ users? How does the network deal with inequalities of resources (time, money, reputation etc)? How are decisions made, rules enforced and conflict resolved?

Number of participants is limited. You can apply for the workshop by e-mail to dubi<at>drugo-more.hr, until 12 February.

Using theatre, improv and role play techniques participants will develop the following premise:

Julian Oliver’s Harvest node has been installed on top of Furtherfield Gallery in Finsbury Park. A wind turbine is generating a small amount of electricity that is powering the graphics card to mine the ZCash cryptocurrency. It is suggested that the surplus value generated by the work should operate as the funding faucet for a body that commissions new environmentally focused cultural practices and projects for and with the visitors to the park where it is based.

Using the Harvest ´fund´, workshop participants will develop a new public artwork proposal that can commission a cultural program in Finsbury Park. The artwork aims to establish a ´headless´ organisational structure that is financially sustainable and incorporates various actors into the cultural program. The aim is to gain ‘real-world’ understanding of how different blockchain value systems may afford alternative social structures for collaborative cultural production.

Ruth Catlow

Ruth Catlow [UK] is an artist, curator, and writer. She is co-director, of Furtherfield, co-founded with Marc Garrett in 1996, an artist led organization for labs, debates and exhibitions around critical questions in arts, technology and society. She has co-devised the ‘DAOWO’ workshop series with Ben Vickers (Serpentine Galleries) & in collaboration with Goethe-Institut London (Oct 2017- Mar 2018). Catlow is named by the Foundation for P2P Alternatives in their list of 100 women Co-creating the P2P society.

Max Dovey

Max Dovey [UK] can be described as 28.3% man, 14.1% artist and 8.4% successful. He is also an artist, researcher and lecturer specialising in the politics of data and algorithmic governance. His works explore the political narratives that emerge from technology and digital culture and manifest into situated projects – bars, game-shows, banks and other participatory scenarios. He holds a BA Hons in Fine Art: Time Based Media and a MA (MDes) in Media Design from Piet Zwart Institute. He is an affiliated researcher at the Institute of Network Cultures and regularly writes for Open Democracy, Imperica & Furtherfield. His work has been performed at Ars Electronica Festival, Art Rotterdam & many U.K based music festivals.

The DAOWO programme is devised by Ruth Catlow (Furtherfield) and Ben Vickers (Serpentine Galleries & unMonastery) in collaboration with the Goethe-Institut London, and the State Machines programme.

This project has been funded with the support from the European Commission. This communication reflects the views only of the author, and the Commission cannot be held responsible for any use which may be made of the information contained therein.

13.30 – 17.30 – Kei Kreutler, Sarah Meiklejohn, Laura Wallis, Jaya Klara Brekke

Doing Good (on the blockchain) is the third event in the DAOWO blockchain laboratory and debate series for reinventing the arts.

In previous workshops we have probed ideas focusing on developments for blockchain application in the arts and the role of identity within the blockchain ecosystem.

Citizen groups that engage in activism and ‘doing good’ are generally structured around informal economies which rely on a certain degree of flexibility, improvisation and indeterminacy of activity. The introduction of technical systems can have a flattening effect that removes all contingency from a system. It sets distinct rules under which an activity or exchange can take place. These rules however can be somewhat opaque, shaped by the affordances of technologies rather than the needs of its users. This event aims to examine what is at stake in the formalisation of ‘doing good’ under blockchain systems for decentralised trust. We will look at how informal systems (e.g. for organising migration from war zones to stable territories) are forced into a formalised rule based structure, while formal systems for public good (eg distribution of social welfare) may exacerbate issues of both exclusion and monitoring. We consider design for contingency, and identify what must be left out.

The Right Systems For The Job?

Sarah Meiklejohn will set the scene sharing her research into developments in systems of decentralised trust, openness and visibility in finance, supply chains, and managing personal data.

This will be followed by 3 provocations that will inform discussion and debate:

Increased Engagement & Resisting De-facto Centralisation

Jaya Klara Brekke on the affordances of Faircoin blockchain technology, exploring its use as a redistribution of what is possible, and for who – extending and reconfiguring spaces and modes of politics.

Incentives for Participation

Laura Willis, on the work of Citizen Me – a platform that promotes the understanding of the value of personal data through notions of citizenship.

Behaviour under Transparency

Kei Kreutler (Gnosis) on blockchain’s potential ability to encode and incentivize social behavior, both on- and off-chain, and designing for unforeseen consequences. How does the figure of the good—politically and aesthetically—influence the uptake of “new” technologies, and how do staked predictions influence the present?

This workshop is devised by Ruth Catlow (Furtherfield) and Ben Vickers (Serpentine) in collaboration with Goethe-Institut London and in partnership with Dr Sarah Meiklejohn from UCL, as part of the research project Glass Houses – Transparency and Privacy in Information Economies.

Sarah Meiklejohn

Sarah Meiklejohn is a Reader in Cryptography and Security at University College London. She has broad research interests in computer security and cryptography, and has worked on topics such as anonymity and criminal abuses in cryptocurrencies, privacy-enhancing technologies, and bringing transparency to shared systems.

Jaya Klara Brekke

Jaya Klara Brekke writes, does research and speaks on the political economy of blockchain and consensus protocols, focusing on questions of politics, redistribution and power in distributed systems. She is the author of the B9Lab ethical training module for blockchain developers, and the Satoshi Oath, a hippocratic oath for blockchain development. She is based between London, occasionally Vienna (as a collaborator of RIAT – Institute for Future Cryptoeconomics) and Durham University, UK where she is writing a PhD with the preliminary title Distributing Chains, three strategies for thinking blockchain politically (distributingchains.info).

Laura Willis

Laura Willis works as Design Lead in user experience at CitizenMe. Alongside this work Laura is also very passionate about illustration and won an award for Macmillan children’s books before she graduated from University of the Arts, London.

Kei Kreutler

Kei Kreutler is a researcher, designer, and developer interested in how cultural narratives of technologies shape their use. She contributes to a range of projects—from the networked residence initiative unMonastery to the augmented reality game for urban research PATTERNIST—related to organizational design and practice. She is Creative Director at Gnosis, a forecasting platform on the Ethereum blockchain, and lives in Berlin.

The DAOWO programme is devised by Ruth Catlow (Furtherfield) and Ben Vickers (Serpentine Galleries & unMonastery) in collaboration with the Goethe-Institut London, and the State Machines programme.

This project has been funded with the support from the European Commission. This communication reflects the views only of the author, and the Commission cannot be held responsible for any use which may be made of the information contained therein.

Information wants to be free, and net art is information. Trying to make it harder to copy is like trying to make water less wet. Or perhaps like trying to give it a soul. In “Blockchain Poetics” I described “new kinds of quasi-property” created using the Blockchain as a mis-application of that technology. Ken Wark is similarly unimpressed – “My Collectible Ass“, he complains in e-flux.

The history of Conceptual Art’s dematerialization of the art object shows that the art market loves nothing more than finding ways to make the previously unsaleable into financial assets. As Wark points out, “We tend to think that what is collected is a rare object.” There’s nothing rarer than something that doesn’t actually exist. But the un-ownable and non-or-barely-existent can be represented as property by proxy objects. Financial elsewheres rather than financial futures.

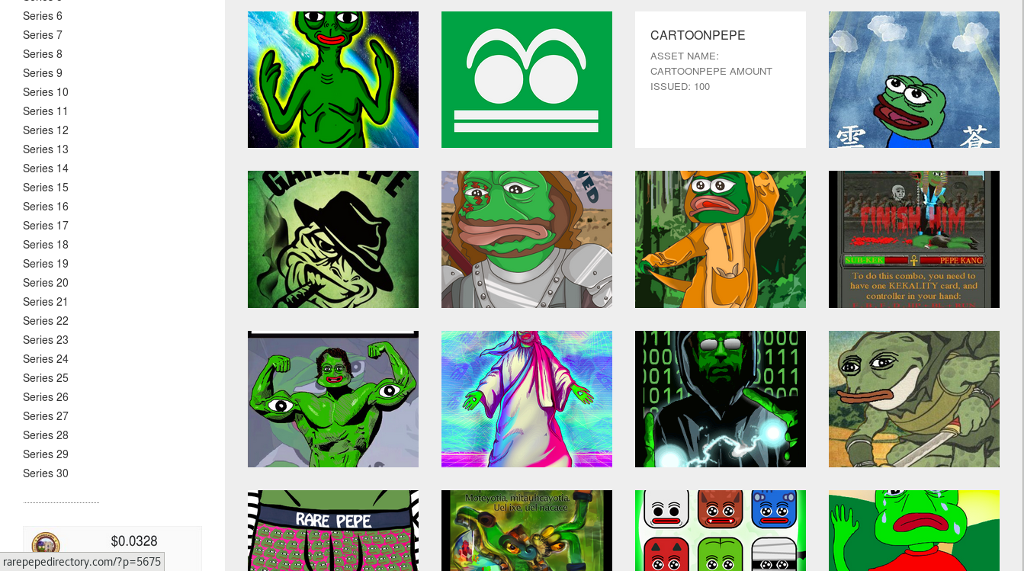

Cryptographic tokens are a generalization of cryptocurrency to represent assets other than money. Such as editions of digital artworks. Wark’s criterion of rarity is reflected in the name of the most successful crypto-token collectibles – “Rare Pepes” are detournements of the “Pepe The Frog” character (previously appropriated by the alt.right) that are sold as CounterParty tokens. CounterParty is a system layered on top of Bitcoin’s blockchain that allows the creation of new tokens with varying properties (different issuance amounts, subdividable or not, locked for further issuance or not, a sub-token of another token) which can then be exchanged and transferred backed by the security of the Bitcoin blockchain. It’s an older system than Ethereum or other platforms that are now used for tokens. It has few major use cases, and Rare Pepes are one of them.

To make a Rare Pepe card you create a CounterParty token with a reference to the image you are using in its metadata, issue as many tokens as you are going to, then lock the token so no more can be issued (making the token “rare”). Rare Pepe quantities, prices and styles vary. There are magazines and virtual galleries devoted to them. There is even a subtoken representing the original physical version of one image (with an edition size of one).

A more singular set of images are the “CryptoPunks” (seen at the top of this page), which exist as an ERC20 token (almost) on the Ethereum blockchain. The “smart contract” that administers the token contains a cryptographic hash of an image of 10,000 bitmapped characters which can be bought and sold using its functions. Like Rare Pepes, the punks have a lighthearted style (they are retro pixellated avatars) and have varying rarity (some features are unique, others appear on dozens of characters) . Unlike Rare Pepes, every punk was created at the start of the project and no more can be added. At the time of writing, punks are available to purchase for 0.12 to 1,010,101,101,110,010,011,000.01 ETH (40.35 to 339,616,193,448,241,111,336,826.06 USD).

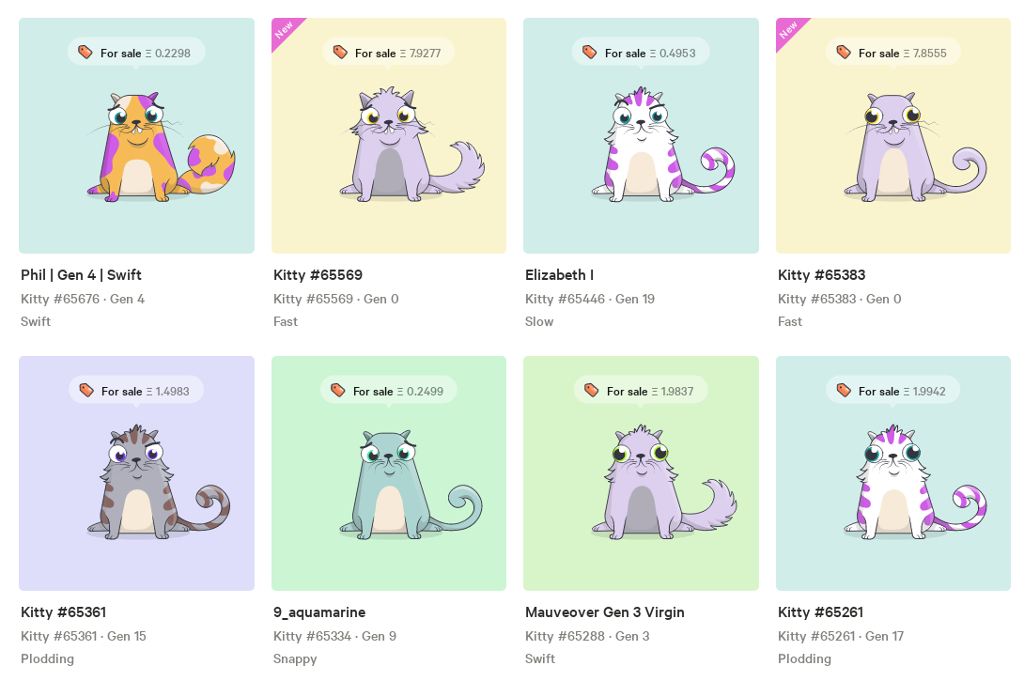

An even more playful approach may be able to take artificially scarce digital collectibles mainstream. CryptoKitties are customized cartoon cats whose appearance is determined by a digital genome (like the old “Cabbage Patch Kids” dolls) that can be interbred to produce more of them (like William Latham’s “Mutator”). At the time of writing they are taking up 13% of the Ethereum network’s capacity, making them the single biggest user of that blockchain, and the most expensive has sold for more than 100,000USD.

Every art is relative to a culture and an economy, whatever its other properties. The ground that tradeable blockchain images are a figure against is a particular moment in the history of cryptocurrency. Trading cards and digital collectibles fit a specific cultural niche, as does their iconography and the socially performative act of dealing in them. Their price may reflect the ability of cryptocurrency early adopters (who in the case of CounterParty and its XCP currency don’t have much else to spend it on) to be more extravagant with their hodlings.

“dada.nyc” follows the tokenized image edition strategy but applies it to popular/illustration art. Again each image is available for a given price in a given edition (for example 0.084 ETH in an edition of 150). The gallery takes a cut, and it takes a cut on profits on the secondary market. It also gives a cut to the artist, simulating Droit de Suite/Artist’s Resale Right. The Resale Right is controversial – it breaks the first sale doctrine and mostly benefits the estates of dead famous artists. But I implemented it as a user-settable property in the Art Market smart contract that I wrote in 2014 as I felt it was worth experimenting with in a voluntary setting.

Monegraph came out while I was working on that project. Like Ascribe it is a serious digital art registry implemented initially using pre-smart-contract technology (NameCoin for Monegraph, Bitcoin for Ascribe). These platforms’ seriousness and phrasing as registries contrasts with the playfulness and explicit tokenizaton of more recent systems. This and the already mentioned possible impacts of the social and economic impact of the increase in value of cryptocurrencies since 2014, along with the increased mainstream awareness of cryptocurrency, may explain the difference in their adoption (or at least their place in the hype cycle).

In contrast, Maecenas is a tokenized investment fund for physical fine art. It operates in part like the scene in William Gibson’s “Count Zero” (1986) in which Marly, one of the protagonists, reflects on how art in the mid-21st century is bought and sold as “points” in the work of a particular artist that represent shares in the value of the “originals” which are stored unseen in a vault. To quote their web site, “investors speculate via synthetic exposure: James is a Modern Art collector who needs to finance the purchase of a new Jeff Koons sculpture worth $120k. Instead of selling items from his collection, or getting an expensive loan, James get the required funding by listing in Maecenas 20% of one of his flagship pieces of art. Access to Maecenas is via an ERC20 token named (ART)” that Maecenas claim will improve access, transparency and fairness in the art market.

Propertization, fractionalization and financialization via proxy tokens (we cannot “own” allographic digital images, or own part of autographic paintings without dismembering them, but we can own tokens that we agree to pretend represent these things) promise to support art production using the economic accident of the value of cryptocurrency going to the moon. Quasiproperty without attempts at the costly fantasy of imposing access control via DRM is a form of, or a variation on the idea of, patronage. I feel this complex of ideas should be more useful to critics of the commodity form and capitalism than it has generally been treated as so far. If we still wish to take the opposite tack this leads us to the gift economy or the commons. Copyright is the default state for most art when it is created and is being increasingly restrictively enforced on the net. Opposing it passively or actively through alternative copyright licensing can perform a critique of this and keep space open for alternatives. These strategies needn’t exclude each other though.

If you are familiar with DAOs, you can see how a system similar to these could become a self-supporting, self-curating DAO. Plantoid is an example of a singular artwork (or family of artworks) produced and exhibited in such a way. Imagine it generalized to a gallery or a participatory art show, a DAO that lets you do art with others, a DAOWO.

These technologies can provide objects for critical exploration that evoke wider contemporary themes. They can function as tools and resources for the creation of art and its social collectivities focussing on these and other themes. Within the existing economy they can provide ways of supporting the arts (as many of the projects mentioned above claim to), which should neither be dismissed reflexively nor accepted without irony. Or they can be used to try to bootstrap a different context entirely, even if only briefly or in the imagination. The various modes of tokenization represent potential ways of making a living in, critiquing, or even transforming the artworld in an era of the continuing expansion of the sphere of private property and financialization under technocapital.

14.00-17.30 – Workshop devised and hosted by Ruth Catlow and Ben Vickers

19.00-20.30 – Panel discussion with Hito Steyerl, Helen Kaplinsky and Julian Oliver

Workshop participants who wish to also stay for the panel event should book for both events individually

Does Art need its own blockchain? Can blockchain technologies help create and retain value for artists and arts organisations? If blockchains are transforming all other industries and supply chains, how will it effect the arts? Is this technology at a stage now where we can begin applying it to our everyday processes and practices?

These are just a few of the questions we have been asking ourselves and others over the course of the last year. In the scheduling and convening of this workshop series we invite others to join us as we delve deeper into the pragmatics of applying these questions to specific scenarios.

Designed as a temporary laboratory for the creation of a living laboratory, the inaugural workshop in the series will take a pragmatic approach in mapping out technical and economic capacity for the application of blockchain technologies within the arts.

This workshop will open with an overview of current developments for blockchain application within the arts ecosystem, outlining the key opportunities and challenges. Serving as the background, this will lead into a series of short presentations by practitioners who have invested their time over the past years unpicking the treacherous complexity of the blockchain. Each of these areas will then be built upon through facilitated working groups – with the explicit objective of enabling initiatives to move into a new phase of development.

As the workshop series unfolds, each lab will work across a spectrum of themes and domains of expertise, breaking down silos and assumptions about what blockchain technologies might mean. The aim is to birth a new set of experimental initiatives with each lab, which can contribute towards rethinking and reinventing the future of the arts as we currently know it.

“If art is an alternative currency, its circulation also outlines an operational infrastructure. Could these structures be repossessed to work differently?” – Hito Steyerl

Following the inaugural workshop of the DAOWO series, this panel will seek to establish a public platform for the discussion of opportunities, dangers and complexity inherent in the very idea of applying blockchain technologies to the production and circulation of art.

Exploring both hands on practical applications and the theoretical long term impact of a technology that enables a vast array of unexpected new conditions, under which the artworld and art market may be forced to operate. From fractional ownership, strict provenance models, untraceable financial transactions, autonomous artworks to new fully automated organisational forms – this panel will seek to unravel and interrogate both the banality and the terror of blockchains future impact on the arts.

Hito Steyerl’s films, installations and writings come out of a systemic way of thinking and working, in which artistic production and the theoretical analysis of global social issues are closely linked. Steyerl investigates the interaction and synthesis of technological and artistic imagery, for example, at the level of visual mass culture – and its function within the overall dispositif of technocracy, monetary policy, the abuse of power, and violence.

Helen Kaplinsky is a curator and writer based at Res., a collaboratively programmed gallery and workspace in Deptford, South East London, currently working in partnership with nearby University of Goldsmiths. Specialising in collection and archive based projects, the thematics and strategies of her curatorial projects consider property in the age of digital sharing. She has contributed to programmes at Whitechapel Gallery, South London Gallery, Glasgow International Festival, ICA (London), The Photographers Gallery (London), and has ongoing programmes with Tate and FACT (Liverpool).

Julian Oliver is a Critical Engineer and artist based in Berlin. Julian has also given numerous workshops and master classes in software art, data forensics, creative hacking, computer networking, counter-surveillance, object-oriented programming for artists, augmented reality, virtual architecture, video-game development, information visualisation and UNIX/Linux worldwide. He is an advocate of Free and Open Source Software and is a supporter of, and contributor to, initiatives that reinforce rights of privacy and anonymity in networked and other technologically-mediated domains. He is the co-author of the Critical Engineering Manifesto and co-founder of Crypto Party in Berlin, who’s shared studio Weise7 hosted the first three crypto-parties worldwide. He is also the co-founder of BLACKLIST, a screening and panel series focused on the primary existential threats of our time.

The DAOWO programme is devised by Ruth Catlow (Furtherfield) and Ben Vickers (Serpentine Galleries & unMonastery) in collaboration with the Goethe-Institut London, and the State Machines programme.

This project has been funded with the support from the European Commission. This communication reflects the views only of the author, and the Commission cannot be held responsible for any use which may be made of the information contained therein.

DOWNLOAD PRESS RELEASE

The blockchain is widely heralded as the new internet – another dimension in an ever-faster, ever-more powerful interlocking of ideas, actions and values. Principally the blockchain is a ledger distributed across a large array of machines that enables digital ownership and exchange without a central administering body. Within the arts it has profound implications as both a means of organising and distributing material, and as a new subject and medium for artistic exploration.

This landmark publication brings together a diverse array of artists and researchers engaged with the blockchain, unpacking, critiquing and marking the arrival of it on the cultural landscape for a broad readership across the arts and humanities.

Contributors: César Escudero Andaluz, Jaya Klara Brekke, Theodoros Chiotis, Ami Clarke, Simon Denny, The Design Informatics Research Centre (Edinburgh), Max Dovey, Mat Dryhurst, Primavera De Filippi, Peter Gomes, Elias Haase, Juhee Hahm, Max Hampshire, Kimberley ter Heerdt, Holly Herndon, Helen Kaplinsky, Paul Kolling, Elli Kuru , Nikki Loef, Bjørn Magnhildøen, Rhea Myers, Martín Nadal, Rachel O Dwyer, Edward Picot, Paul Seidler, Hito Steyerl, Surfatial, Lina Theodorou, Pablo Velasco, Ben Vickers, Mark Waugh, Cecilia Wee, and Martin Zeilinger.

Read a review of the book by Regine Debatty for We Make Money Not Art

Read a review of the book by Jess Houlgrave for Medium

While archaeology has often understood cultures through excavations of hoards and coins, what will today’s digital currencies tell future archaeologists about the way we live and trade?

This co-commission with NEoN Digital Arts Festival forms part of Furtherfield’s ongoing investigations into the politics of the blockchain, smart contracts, and cryptocurrency systems like Ethereum. It invites artists to imagine themselves as future media archaeologists, as recorders of our current information-based society, and as time-travelers highlighting the continued relevance of our long past. Will you dig for the digital, brush the dirt off the non-material, or excavate the internet?

In an era that threatens to be a digital dark age for future historians [1], blockchains may prove to be rare digital artefacts valuable enough to preserve into the future. There are already dozens of dead chains from abandoned cryptocurrencies [2], but with billions of dollars of value tied up in Bitcoin, Ethereum and other leading coins, the incentives to maintain their public ledgers are strong. Culture and knowledge have already been hidden in the blockchain – from images of Nelson Mandela to WikiLeaks cables [3] – but it is the blockchain as a record of our economic activity that concerns us here. This already has its history; on these public digital ledgers we can find everything from the ten thousand Bitcoins that were used to buy two pizzas [4] to the fifty million dollars of Ether that were stolen [5] in a hack on code running on the Ethereum blockchain. We just don’t have the best tools to visualise them yet.

We invite proposals for a new artistic online commission that takes the blockchain as the site of its manifestation. For example, artworks that are:

Whatever it is, it should work as a future media archeological artefact of blockchain finance and it has to be exhibitable online.

Hailed as both emancipatory opportunity for creative autonomy, and a driver of inequality and corporate opacity, the blockchain [10] is widely described as the Internet of Money. The blockchain is overtaking the WWW as the next big network technology for speculation and disruption. Investors recognise its potential in numerous ways: for high level authentication of identity [11] and matter [12]; for more efficient and secure financial transactions and distribution of digital assets; for communications so secure as to facilitate voting; and as a coordinating technology for the billions of devices connected to the Internet [13]

50 years ago this year, the world’s first ATM was designed, built and shipped from Dundee and installed in Enfield, less than 10 miles from Furtherfield. With this commission Furtherfield and NEoN recognise the role that the city of Dundee has played in the history of the development of smart technologies for financial transactions, through it being home to the R&D wing of The National Cash Register Corporation – NCR. [14]

NEoN Digital Arts Festival 2017 will expand on it being Scotland’s Year of History, Heritage and Archaeology, and seek to use its arts programme to unveil hidden histories through the practice of ‘media archaeology’. Media archaeologists uncover and reconsider the obsolete, persistent, and hidden material cultures of the technological age – from big data software algorithms to tiny silicon chips. With support from the National Lottery through Creative Scotland’s Open Project Fund, and Creative Europe Programme of the European Union, NEoN and Furtherfield invite artists to consider how the blockchain is the new ATM of the future.

The commission will be launched online and at NEoN Digital Arts Festival, and presented at the Digital Futures programme at V&A Museum and MoneyLab both in London in Spring 2018 as part of the European collaboration, State Machines which investigates the new relationships between states, citizens and the stateless made possible by emerging technologies.

Open Call announced 11th August

Deadline 4th September

6-9 September – follow up conversations where necessary (by email/phone)

13th September – decision made, artists informed and announced

19th September – public debate about cryptocurrencies in Dundee (organised by Scotcoin https://www.meetup.com/scotland-and-digital-currency/events/242087813/)

9th October – selected artist give progress report

9th November – Work installed for opening of NEoN Festival, Dundee. Artist presents work

Spring 2018 – Work re-presented with MoneyLab and V&A Digital Futures

(Note an additional £500 is available for accommodation and expenses for attendance at events in Dundee and London)

Submissions must include a proposal:

Documents should be submitted as PDFs or as links to a Google Doc, a GitHub Repo, or another easily read and easily accessed format.

If you have questions or enquiries about this commission please email alison.furtherfield[AT]Gmail.com

Notice of submissions via the Bitcoin blockchain should be sent via an OP_RETURN message starting with the word FField followed by a single space and the url of the proposal. E.g.:

FField https://docs.google.com/document/d/2oGsmli7Mlm-M_CZkL8WTKM3oUU3a

OP_RETURN messages can be created using the Crypto Grafitti service:

http://www.cryptograffiti.info/

Notice of submissions via Keybase messaging, or submissions of documents via KeybaseFS should be sent to:

(Note: Keybase does require registration but is free to join.)

Notice of submissions, or submissions of documents via email can be sent to ruth.catlow[AT]furtherfield.org

Please use the subject line “Furtherfield NEoN Proposal”.

Furtherfield

Through artworks, labs and debate around arts and technology, people from all walks of life explore today’s important questions. The urban green space of London’s Finsbury Park, where Furtherfield’s Gallery and Lab are located, is now a platform for fieldwork in human and machine imagination – addressing the value of public realm in our fast-changing, globally connected and uniquely superdiverse context. An international network of associates use artistic methods to interrogate emerging technologies to extend access and grasp their wider potential. In this way new cultural, social and economic value is developed in partnership with arts, research, business and public sectors.

NEoN

NEoN (North East of North) based in Dundee, Scotland aims to advance the understanding and accessibility of digital and technology driven art forms and to encourage high quality within the production of this medium. NEoN has organised 7 annual festivals to date including exhibitions, workshops, talks, conferences, live performances and public discussions. It is a platform to showcase national and international digital art forms. By bringing together emerging talent and well-established artists, NEoN aims to influence and reshape the genre. We are committed to helping our fabulous city of Dundee, well known for its digital culture and innovation, to become better connected through experiencing great art, networking and celebrating what our wee corner of Scotland has to offer in the field of digital arts.

State Machines: Art, Work and Identity in an Age of Planetary-Scale Computation

Focusing on how such technologies impact identity and citizenship, digital labour and finance, the project joins five experienced partners Aksioma (SI), Drugo More (HR), Furtherfield (UK),Institute of Network Cultures (NL) and NeMe (CY) together with a range of artists, curators, theorists and audiences. State Machines insists on the need for new forms of expression and new artistic practices to address the most urgent questions of our time, and seeks to educate and empower the digital subjects of today to become active, engaged, and effective digital citizens of tomorrow.

V&A Digital Futures: Digital Futures

V&A Digital Futures: Digital Futures is a monthly meetup and open platform for displaying and discussing of work by professionals working with art, technology, design, science and beyond. It is also a networking event, bringing together people from different backgrounds and disciplines with a view to generating future collaborations.

Creative Scotland

Creative Scotland is the public body that supports the arts, screen and creative industries across all parts of Scotland on behalf of everyone who lives, works or visits here. It enables people and organisations to work in and experience the arts, screen and creative industries in Scotland by helping others to develop great ideas and bring them to life. It distributes funding from the Scottish Government and The National Lottery.

This project has been funded with the support from the European Commission. This communication reflects the views only of the author, and the Commission cannot be held responsible for any use which may be made of the information contained therein.

The Road to Budgetary Blockchain Bliss, is a 2 hour Live Action Role Play adventure for the Blockchain-curious of all tribes including: hackers, lawyers, activists, artists, financiers, designers, venture capitalists, developers, marketeers.

Players adopt a fictional future version of themselves and work with others to solve a real-world problem. They learn about and build DAOs and Dapps (machine-based organisations and apps on the blockchain) and act out the social discomforts, asymmetries, dramas and politics of collaboration and coalition-formation across difference….starting with the budget!

NO PRIOR BLOCKCHAIN KNOWLEDGE NECESSARY

Fill out the application survey to ensure that you are assigned a compatible player character and so increase your chances of achieving your objective – fictionalise at will.

The Road to Budgetary Blockchain Bliss

Devised by Ruth Catlow, Furtherfield and Ben Vickers, unMonastery & Serpentine Galleries

WHEN?: Prompt start – 13:45 – 15:40 on Friday 2 Dec 2016

WHERE? The Presentation Room

As part of MoneyLab #3 Failing Better Symposium | Workshops | Exhibition,

Pakhuis de Zwijger, Amsterdam A two-day symposium,

1 – 2 December 2016, featuring talks, workshops and performances that confront the notion that finance is too big to fail.

Tickets: € 10 per session; € 30 per day, € 60 two day pass Students: 50% discount on all tickets

Plantoid (2015) by Okhaos is a self-creating, self-propagating artwork system that uses blockchain technology to gather and manage the resources it needs to become real and to participate in the artworld. Structured as a Decentralised Autonomous Organization (DAO), once it is set in motion the code of the Plantoid system combines the functions of artwork, artist and art dealer in a single piece of software.

As its name implies, the physical Plantoid artworks are cyborg-looking welded sculptures of flowering plants. Flowers are a popular icon of naturalised aesthetics in art and culture. Their aesthetic and art historical appeal makes them an effective subject for subversion. Radicalized flowers wander through recent art like triffids through the English countryside. Helen Chadwick’s “Piss Flowers” (1991-2) are a proto-xenofeminist riposte to idealisation of nature and the body. Mary Anne Francis’s “The Blooming Commons” (2005) combines the ideas of organic and creative fecundity to help artist and audience consider how making art open source affects its aura. Plantoid can easily be cast in this tradition.

The physical form of Plantoid is determined by its blockchain presence, which represents an advance on the state of the art. The Bitcoin blockchain is a database that represents control of resources. Most simply these resources are amounts of Bitcoin but we can encode information representing other resources – and the right to control them – into the blockchain as well. Current general purpose Bitcoin blockchain-based systems such as Counterparty can easily represent tokens for games, for reward and voucher schemes, or for stocks and shares. Placing these on the blockchain does not magically improve them over existing means of issuing them but it does reduce their barrier to entry and make securing and maintaining them easier. It also defamiliarises them by placing them in a new context and makes them accessible and thereby inspirational to new audiences. Melanie Swan turns this idea up to 11 in her excellent survey of the state of the art and its future potential “Blockchain“, describing the application of the idea of blockchains ultimately to the global economy and even the human mind.

Beyond tokens, the blockchain can be a cheap and effective database of existing property and rights, including recording Free Culture licensing. It is simple to create such a system, I made the first one for artworks based on Ethereum myself. It cannot be an effective means of policing DRM (as DRM is inherently broken) and must not be treated as a means of rolling back the limits of and exceptions to the existing property and copyright regimes or of creating new entitlements ex nihilo. This would turn a technology with great (if contentious) potential for liberation into a tool of exploitation. Making a GIF of Apple’s new emoticons and selling the blockchain title to it for $250 reflects existing social pathologies rather than new technological or artistic affordances.

The technobiophilic machine-nature-form hybrid nature of Plantoid is described by Okhaos in terms that cast cryptocurrency as metabolic and reproductive resources. To quote the project page:

Perhaps the initial Plantoid will need $1000 to fully turn into a blossom. Whenever that particular threshold for the Plantoid is reached, the reproduction process starts: the Plantoid only needs to identify a new person or group of persons (ideally, a group of artists) to create a new version of itself. Given the right conditions, the Plantoid is able to manufacture herself, by executing a smart contract that lives on the blockchain, and has the ability to commission welders, companies, and other beings to build and assemble a similar being.

It’s here that we see how Plantoid represents an advance on existing systems. The parameters of each physical Plantoid are encoded on the Ethereum (rather than the Bitcoin) blockchain as smart contracts, representing the economic and manufacturing logic and the aesthetics of its production as a kind of genome. Plantoid is an active artistic production agent rather than a passive registry of existing art.

The defamiliarising effect of the blockchain allows us to unbundle the collections of rights and responsibilities that make up roles within the mainstream artworld. Paying for the creation of art, its storage and restoration, transport and exhibition. Inspiring, designing, manufacturing, promoting, experiencing, critiquing and art. The artist, the gallerist, the critic, the installer, the attendant. A new territory like the blockchain allows us to shake things up rather than to try to double down on existing relations and distribution of wealth in order to extract new rents.

Plantoid opens up the roles of artistic production in precisely this way. It uses the structure of a DAO to incentivise the funding, governance, production, exhibition and reception of Plantoids in a virtuous circle (a positive feedback loop of production). None of this confers ownership or property rights over the physical Plantoid artworks on individual human beings. Their relationships are closer to those of patronage, crowdfunding, or tipping but unbundled further. There are technological precedents for this such as the way Aaron Koblin’s “The Sheep Market” (2008) commissions drawings from clickworkers, Caleb Larsen’s “A Tool To Deceive And Slaughter” (2009) manages its own sale, the way Bitnik’s “Random Darknet Shopper” (2014) orders goods for delivery to the gallery, or Imogen Heap’s release of the single “Tiny Human” (2015) using Ethereum smart contracts

From the project page again:

Plantoids are part of an ecosystem of relationships that is powered by two driving forces: aesthetic beauty and automated governance. Plantoids subtly motivate these interactions, partly through their form and physical beauty, but also by empowering people to participate in their governance. Participants (that is, active members of the DAO) are able to decide on such things as where the Plantoids may be exhibited, whom they might visit, and exactly how they are to be reproduced.

When it receives funds by the audience, the Plantoid evolves and turns into a more beautiful flower, by e.g. moving around a means to gratify the donor and progressively opening up its petals as more and more funds are stored into its wallet. Once enough funds are secured, the Plantoid can use this money to reproduce itself, by commissioning a third party to produce a new Plantoid.

The smart contracts that instantiate these relationships contractually direct human actors to govern the DAO, to manufacture new Plantoids, and to exhibit (and return) the work. The danger of such DAOs is that of any embedded socioeconomic intent – whether corporations, charitable trusts or high frequency trading bots. We may end up with an economic Skynet that reduces us to peons in an algorithmic gig economy, any reflection of our actual needs or desires (such as to make art) perverted by the incentives encoded into an inhuman system. Plantoid exists to ensure the production of art, and its realisation by human artisans. Given the rockstar economics of the artworld and the continued collapse of socioeconomic support for artists outside it that production is badly in need of new means of continuance. The art-economic equivalent of “grey goo” – polychrome goo? – or Terminators armed with spraycans rather than phased plasma rifles seem much less likely scenarios than art DAOs becoming lifeboats or TAZes for the funding of art that is not simply decoration for the 1%. Plantoid’s explicit involvement of human producers in a comradely relationship makes it more a node in the network of collaborative and mutually supportive relationships in the peer economy than an Uberization of artistic production.

Any gap between the ambition and the technology of Plantoid can be crossed by its autopoeitic nature. Ethereum contracts cannot yet manage Bitcoin balances, for example, but using Ethereum’s existing native cryptocurrency “Ether” or one of the proposed systems for managing Bitcoin accounts from Ethereum would address this. Art’s function here, as in its development of religion at the dawn of history, is to create demand for the development of new means of production and relation that a dryly complete rational plan could not reach. Appropriately enough for such a hyperstitional work I discovered it via the blog of renegade philosopher Nick Land.

Without wishing to ventriloquise or reframe its achievements, Plantoid is an exemplary realisation of the potential of mutual interrogation and support of art and cryptocurrency. It’s an art project that uses cryptocurrency and smart contract systems to materially support itself. And that project makes the still abstract potential and operation of cryptocurrency and smart contract tractable to consideration through art. I for one welcome our new hyperstitional DAO artwork overlords.

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Many of both Bitcoin’s most vocal proponents and detractors agree that the way the cryptocurrency operates technologically determines the form of the economy and therefore the society that uses it. That society would be anarcho-capitalist, lacking state institutions (anarcho-) but enforcing commodity property law (capitalist). If this is true then Bitcoin has the potential to achieve a far greater political effect than financial engineering efforts like the Euro or quantitative easing and with far fewer resources. Perhaps variations on this technology can create alternatives to Bitcoin that determine or at least afford different socioeconomic orders.

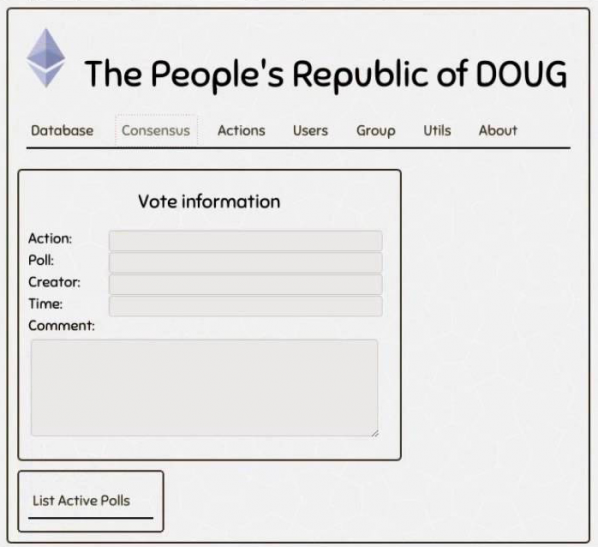

Bitcoin is already more than half a decade old and “Crypto 2.0” systems that build on its underlying blockchain technology (the blockchain is a network-wide shared database built by consensus, Bitcoin uses it for its ledger) are starting to emerge. The most advanced allow the creation of entire organizations and systems of organization on the blockchain, as Decentralized Autonomous Organizations (DAOs). We can use them to help create those different socioeconomic orders.

Workers’ Councils are a Liberatarian Socialist system of organization. Rather than implementing Soviet-style centralized command economies, workers councils are decentralized and democratic. Workers in a particular workplace decide what their objectives are then appoint temporary (and instantly revocable) delegates to be responsible for them. Workplaces appoint representatives to local councils, local councils appoint representatives to regional councils, and so on, always temporarily and revocably. It is a system of face to face socialisation and political representation rather than top-down control.

This system emerged at various times in Europe, South America and the Middle East throughout the Twentieth Century. It is a very human method of governance, in stark contrast to the “trustless” code of Bitcoin as well as to the centralized politics of the Soviets. That said, technology can assist organization as easily as it can support material production. In the 1970s the cordones of Chile interfaced with the Allende government’s Project Cybersyn network, and contemporary online workers collectives can use the Internet to co-ordinate.

A DAO is a blockchain-based program that implements an organization’s governance and controls its resources using code rather than law. There can be a fetishistic quality to the idea of cold, hard, unyielding software perfect in its unambiguous transparency and incapable of human failing in its decision making. There can be similar fetishistic qualities to legal and political organizational perfectionism, this doesn’t disqualify any of their subjects as useful ideals however they need to be tempered pragmatically.

Using the public code and records of a DAO can help with the well known problem of structurelessness, and can store information more efficiently and reliably than a human being with a pen and paper. The much vaunted trustlessness of cryptovurrency and smart contract systems can help build trust in communication within and between groups – cryptographically signed minutes are relatively hard to forge although the ambiguity of language is impossible to avoid even in the mathematics of software.

The delegates of a workers’ council can be efficiently and transparently voted on, identified by, and recalled using a DAO. This makes even more sense for distributed groups of workers, groups that share a common cause but lack a geographic centre. Delegates can even be implemented as smart contracts, code written to control resource allocation and evaluate performance in the pursuit of their objective (unless recalled by the council that created them).

Entire councils, and inter-council organisation, can be supported or implemented in their organization as DAOs. Support includes communication and record keeping. Implementation included control of resources, running delegates as code, and even setting objectives for delegates programatically.

The latter finally brings the concept of DAOs into direct conflict with the spirit of the Workers’ Council. Councils exist to allow individual human beings to express and agree on their objectives, not to have them imposed from above. Being controlled by code is no better than political or economic control. It is the nature of this relationship to code, politics or the economy that is positive or negative – writing code to charge someone or something with seeing that a task be undertaken is no different from writing it in the minutes and makes mroe explicit that organization is production as the subject of work in itself. A democratic, recallable DAO that sets objectives is very different from a blob of capital with unchangeable orders to maximise its profits online.

The resources that a DAO controls need not be monetary (or tokenized). A DAO that controls access to property, energy or other resources can contribute to avoiding the pricing problem that conventional economics regarded as a showstopper for the Soviet cybernetic economic planning of “Red Plenty“. DAOs need not even be created to represent human organization – “deodands” can represent environmental commons as economic actors. These can then interact with workers council DAOs, representing environmental factors as social and economic peers and avoiding the neoliberal economic problems both of externalities and privatisation.

Workers Council DAOs – Decentralized Autonomous Workers Councils (DAWCs) are science fiction, but only just. Workers councils have existed and been plugged in to the network, structurelessnes and scalability are problems, DAOs exist and can help with this. Simply tokenizing “sharing economy” (actually rentier economy) forms, for example replacing Uber’s taxi sharing with La’zooz, while maintaining the exploitative logic of disintermediation isn’t enough.

If we are unable or unwilling to accelerate the social and productive forces of technology to take us to the moon, we can at least embrace and extend them in a more human direction.

The text of this article is licenced under the Creative Commons BY-SA 4.0 Licence.

DOWNLOAD

PRESS RELEASE (pdf)

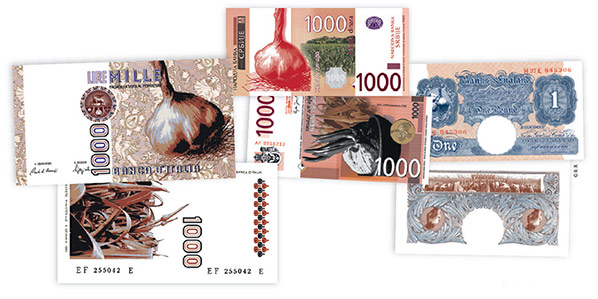

‘Agliomania, eating and trading my stinky roses’ by Shu Lea Cheang. Courtesy of the artist and MDC #76 We Grow Money, We Eat Money, We Shit Money.

SEE IMAGES FROM THE PRIVATE VIEW

Featuring Émilie Brout and Maxime Marion, Shu Lea Cheang, Sarah T Gold, Jennifer Lyn Morone, Rhea Myers, The Museum of Contemporary Commodities (MoCC), the London School of Financial Arts and the Robin Hood Cooperative.

Furtherfield launches its Art Data Money programme with The Human Face of Cryptoeconomies, an exhibition featuring artworks that reveal how we might produce, exchange and value things differently in the age of the blockchain.

Appealing to our curiosity, emotion and irrationality, international artists seize emerging technologies, mass behaviours and p2p concepts to create artworks that reveal ideas for a radically transformed artistic, economic and social future.

Have you ever looked for faces in the clouds, or in the patterns in the wallpaper? Well, Facecoin is an artwork that is a machine for creating patterns and then finding ‘faces’ in them. It is both an artwork AND a prototype for an altcoin (a Bitcoin alternative).

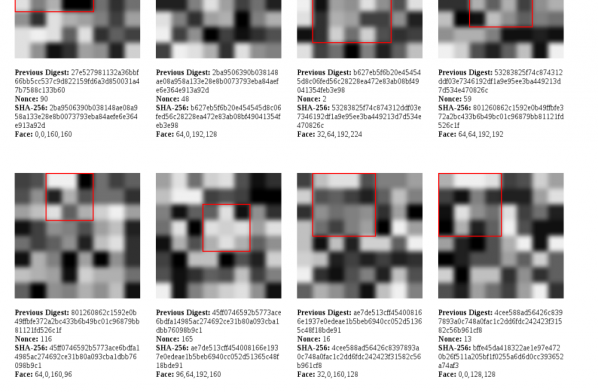

Facecoin creates patterns by taking the random sets of data used to validate Bitcoin transactions and converting them into grids of 64 grayscale pixels. It then scans each pixel grid, picking out the ones that it recognises by matching its machine-definition of a human face. Facecoin uses the production of “portraits” (albeit by a machine) as a proof-of-aesthetic work. Facecoin is a meditation on how we discern and value art in the age of cryptocurrencies.

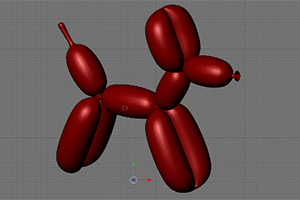

Shareable Readymades are iconic 3D printable artworks for an era of digital copying and sharing.

Duchamp put a urinal in a gallery and called it art, thereby transforming an everyday object and its associated value. Rhea Myers takes three iconic 20th century ‘readymades’ and transforms their value once again. By creating a downloadable, freely licensed 3D model to print and remix, everyone can now have their own Pipe, Balloon Dog and Urinal available on demand. Click here to collect your own special edition version of these iconic artworks.

A hoard of golden trinkets to appeal to our inner Midas. An image projection of found GIFs, collected from the internet, creates a gloriously elaborate, decorative browser-based display hosted at www.goldandglitter.net. It prompts reflections on the value of gold in an age where the value of global currencies are underpinned primarily by debt, and where digital currencies are mined through the labour of algorithms.

Also by Émilie Brout and Maxime Marion:

Nakamoto (The Proof) – a video documenting the artists’ attempt to produce a fake passport of the mysterious creator of Bitcoin, Satoshi Nakamoto.

Untitled SAS – a registered company with 10,000 shares that is also a work of art. SAS is the French equivalent of Corp or LTD. http://www.untitledsas.com/en

Jennifer Lyn Morone™ Inc reclaims ownership of personal data by turning her entire being into a corporation.

The Museum of Contemporary Commodities by Paula Crutchlow and Dr Ian Cook treats everyday purchases as if they were our future heritage. The project is being developed with local groups in Finsbury Park in partnership with Furtherfield.

The Alternet by Sarah T Gold conceives of a way for us to determine with whom, and on what terms, we share our data.

Shu Lea Cheang anticipates a future world where garlic is the new social currency.

Also, as part of Art Data Money, join us for data and finance labs at Furtherfield Commons.

LAB #1

Share your Values with the Museum of Contemporary Commodities

Saturday 17 October, 10:30am-4:30pm

A popular, data walkshop and lego animation event around data, trade, place and values in daily life.

Free – Limited places, booking essential

LAB #2

Breaking the Taboo on Money and Financial Markets with Dan Hassan (Robin Hood Coop)

Saturday 14 & Sunday 15 November, 11:00-5:00pmA weekend of talks, exercises and hands-on activities focusing on the political/social relevance of Bitcoin, blockchains, and finance. All participants will be given some Bitcoin.

£10 per day or £15 for the weekend – Limited places, booking essential

LAB #3

Building the Activist Bloomberg to Demystify High Finance with Brett Scott and The London School of Financial Arts

Saturday 21 & Sunday 22 November, 11:00-5:00pm

A weekend of talks, exercises and hands on activities to familiarise yourself with finance and to build an ‘activist Bloomberg terminal’.

£10 per day or £15 for the weekend – Limited places, booking essential

LAB #4

Ground Truth with Dani Admiss and Cecilia Wee

Saturday 28 November, 11-5pm

Exploring contemporary ideas of digital agency and authorship in post-digital society.

LAB #5

DAOWO – DAO it With Others

November/February

DAOWO – DAO it With Otherscombines the innovations of Distributed Autonomous Organisations (DAO) with Furtherfield’s DIWO campaign for emancipatory networked art practices to build a commons for arts in the network age.

Émilie Brout & Maxime Marion (FR) are primarily concerned with issues related to new media, the new forms that they allow and the consequences they entail on our perception and behaviour.Their work has in particular received support from the François Schneider Foundation, FRAC – Collection Aquitaine, CNC/DICRéAM and SCAM. They have been exhibited in France and Europe, in places such as the Centquatre in Paris, the Vasarely Foundation in Aix-en-Provence, the Solo Project Art Fair in Basel or the Centre pour l’Image Contemporaine in Geneva, and are represented by the 22,48 m² gallery in Paris.

Shu Lea Cheang (TW/FR) is a multimedia artist who constructs networked installations, social interfaces and film scenarios for public participation. BRANDON, a project exploring issues of gender fusion and techno-body, was an early web-based artwork commissioned by the Guggenheim Museum (NY) in 1998.

Dr Ian Cook (UK) is a cultural geographer of trade, researching the ways in which artists, filmmakers, activists and others try to encourage consumers to appreciate the work undertaken (and hardships often experienced) by the people who make the things we buy.

Paula Crutchlow (UK) is an artist who uses a mix of score, script, improvisation and structured participation to focus on boundaries between the public and private, issues surrounding the construction of ‘community’, and the politics of place.

Sarah T Gold (UK) is a designer working with emerging technologies, digital infrastructures and civic frameworks. Alternet is Sarah T Gold’s proposal for a civic network which extends from a desire to imagine, build and test future web infrastructure and digital tools for a more democratic society.

Dan Hassan (UK) is a computer engineer active in autonomous co-operatives over the last decade; in areas of economics (Robin Hood), housing (Radical Routes), migration (No Borders) and labour (Footprint Workers). He tweets as @dan_mi_sun

Jennifer Lyn Morone (US) founded Jennifer Lyn Morone™Inc in 2014. Since then, her mission is to establish the value of an individual in a data-driven economy and Late Capitalist society, while investigating and exposing issues of privacy, transparency, intellectual property, corporate governance, and the enabling political and legal systems.

Rhea Myers (UK) is an artist, writer and hacker based in Vancouver, Canada. His art comes from remix, hacking, and mass culture traditions, and has involved increasing amounts of computer code over time.

Brett Scott (UK) is campaigner, former broker, and the author of The Heretic’s Guide to Global Finance: Hacking the Future of Money (Pluto Press). He blogs at suitpossum.blogspot.com and tweets as @suitpossum

The Human Face of Cryptoeconomies is part of Art Data Money, Furtherfield’s new programme of art shows, labs and debates that invites people to discover new ways for cryptocurrencies and big data to benefit us all. It responds to the increasing polarisation of wealth and opportunity, aiming to build a set of actions to build resilience and sustain Furtherfield’s communities, platforms and economies.

About Furtherfield

Furtherfield was founded in 1997 by artists Marc Garrett and Ruth Catlow. Since then Furtherfield has created online and physical spaces and places for people to come together to address critical questions of art and technology on their own terms.

Furtherfield Gallery

McKenzie Pavilion

Finsbury Park, London, N4 2NQ

Visiting Information

[Notes:

1. These are the minimally reformatted and slightly expanded notes for what would have been a 15-minute presentation.

2. The presentation was meant to be followed by questions and form part of the introduction to a panel discussion. Any questions in the comments here or on netbehaviour gratefully received.]

Art and money have always been involved in each other’s production. This is a Greek Drachma from 600BC with a relief depiction of a sea turtle on one side. For many people this would be the artwork, or at least the image, that they saw most frequently in their everyday lives.

In the present day, high art and high finance (or big art and big finance) go hand in hand. Blue chip artworks produced by brand name artists like Jeff Koons are collected by hedge fund managers and oil oligarchs as investments and as signifiers of socioeconomic position (while stolen Old Master paintings are used as signifiers of value in transactions between criminal gangs…). This tendency reaches its logical conclusion for now with Damien Hirst’s “For The Love of God” (2007), a diamond-encrusted platinum cast of an actual human skull complete with the original teeth. It was sold for fifty million pounds sterling.

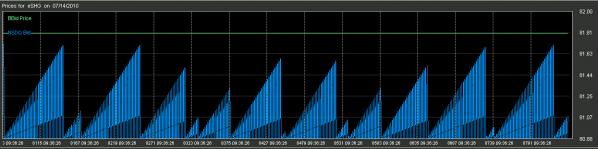

Looking inside the sale of “For The Love Of God” makes its narrative less straightforward. It was sold to a group including the artist and their dealer, making the actual figure and its ownership less straightforward than a simple sale would suggest. Nanex’s High Frequency Trading visualizations from 2010 look inside transcations in electronic stocks & shares markets, finding aesthetic forms in the activity of share trading bots. What the sawtooth waves of this bot’s activity represent is unknown: a glitch, a strategy, a side-effect. But without making these forms visible, we would not be able to ask these questions or reflect on this economic activity.

It is part of the value of art, particularly Conceptual Art, that it can afford us these opportunities for reflection and critique. Cildo Meireles’ “Insertions Into Ideological Circuits 2” (1970) overwrites the contemporary equivalent of the Drachma’s turtle with a rubber stamped message on a banknote, intruding into everyday use and circulation of currency in order to give its audience a pause for critical reflection.

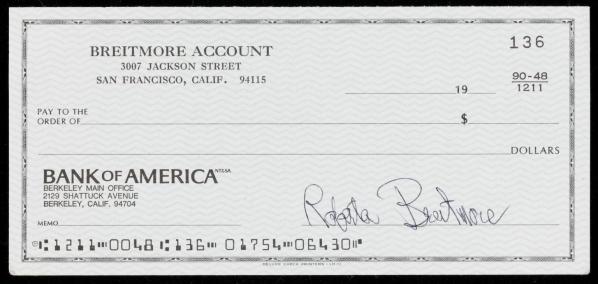

Lynn Hershman’s “Check” (1974) is signed by their artistic alter ego Roberta Breitmore, using financial transactions and their attendant contracts as a producer and guarantor of identity, literally underwriting it.

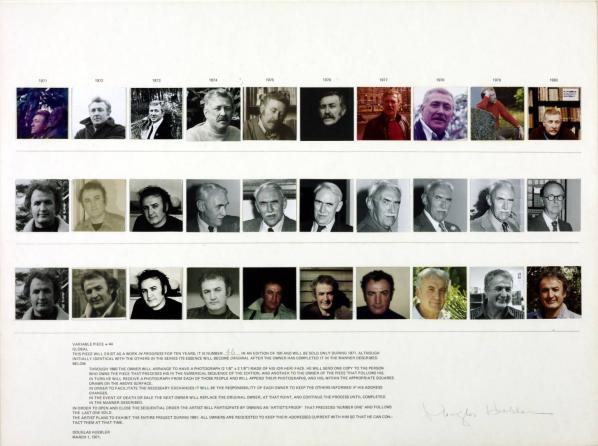

Douglas Huebler’s “Variable Piece no.44” (1971) incorporates an image of its current owner into itself each year for its first decade, in an analogue precedent for Bruce Sterling’s idea of “spimes”. When the artwork is sold a new owner appears, making the artwork’s contingent economics its aesthetic subject.

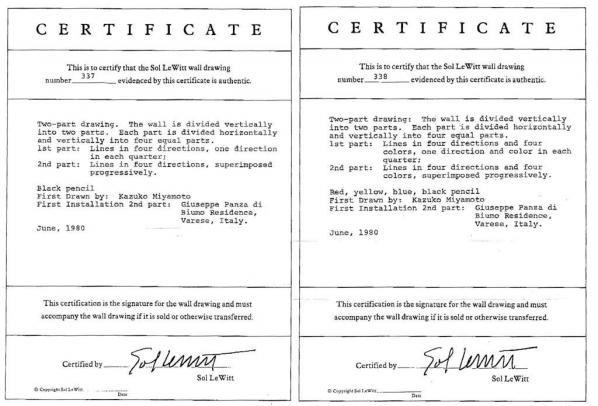

The initial critique of the ontology and economics of art that Conceptual Art represented in its “dematerialisation” phase represented as much of a challenge for the livelihoods of artists as it did to its chosen targets. One solution found early on was to produce certificates of authenticity or ownership for otherwise un-ownable art. This re-appropriates conceptual art for scarcity economics and as property, returning it to the market. Sol LeWitt’s certificates for two wall drawings (1980) demonstrate how this works. If you own such a certificate and I do not, and we both follow the instructions on the certificate, you produce an authentic LeWitt and I at best produce a forgery.

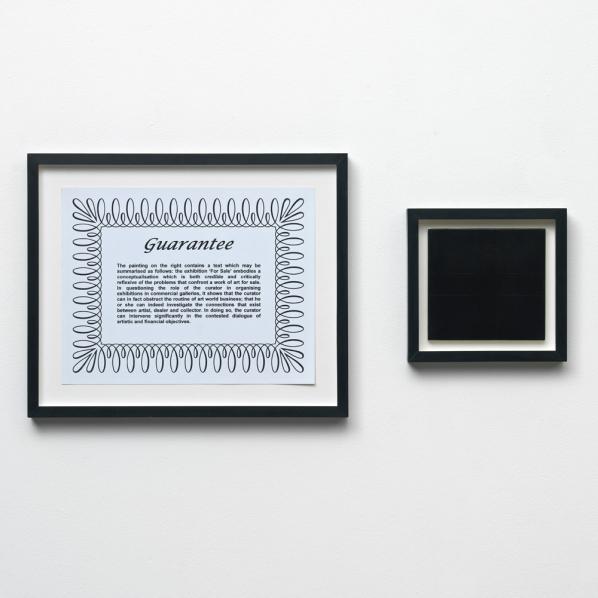

This stretegy was criticised (and parodied) within the Conceptual Art movement itself. An early Art & Language artwork, “Guaranteed Painting” (1967), contains a printed certificate guaranteeing that the painting accompanying it contains particular content and addressing the curator of the show it appears in as someone who can possibly intervene in artworld economic relationships.

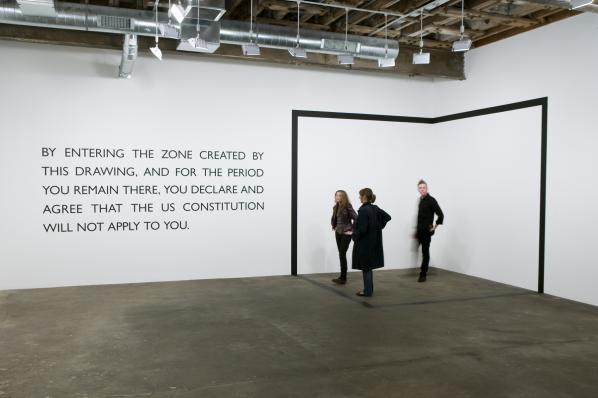

Carey Young’s “Declared Void” (2005) is a wall drawing that creates a space in which its audience enters into a contract agreeing that the constitution of the United States. Legal form as sculptural form, this is no longer about the relationship between art and money but rather between the individual, contract law, and the state. This is the kind of relationship that produces money, or at least fiat currency, and is a broader context for considering the more specific relationship between art and money.

I love this flower currency from 2005, produced by a group of Viennese artists. It’s both a LETS-style complementary currency and a use of the aesthetics of pressing flowers to allegorize and aestheticize the relationship between nature, production, and value in economies.

This Danica Phelps stripe drawing (2013) shows the artist’s expenditure on reparing their car. If it depicted income rather than outcome the stripes would be green rather than red. Phelps’ work combines the ledger of their economic existence with the artistic record of their social presence.

Bitcoin emerged as a critique of state-issued “fiat” currency following the financial crisis of 2008. Bitcoin is a cryptocurrency, a piece of software that runs on computers (“nodes”) spread across the network that communicate with each other to reach a shared consensus on the current state of a cryptographically-secured ledger. Every ten minutes or so these computers bundle up transactions into “blocks”, each of which refers to the previous block. This is the “blockchain”. This is yodark’s fanciful depiction of the blockchain proceeding from the first block of transactions, the “genesis block”.

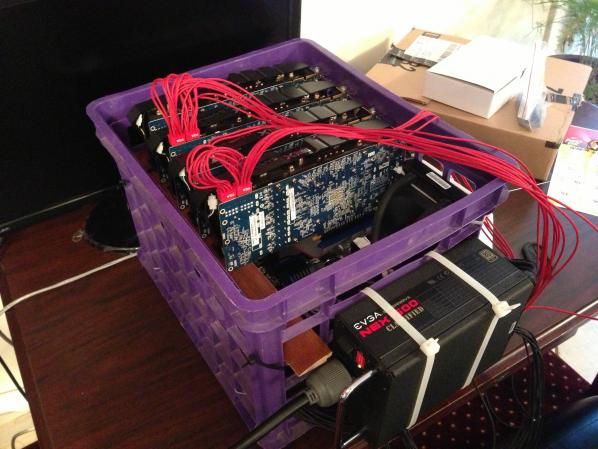

In reality news blocks in the chain are validated (or “mined”) by nodes in the network using increasingly specialised hardware, such as this milk crate mining rig from a couple of years ago. They perform difficult to solve but easy to validate sums on each block, the “proof of work”, and the first node to succeed gets a reward (paid in Bitcoins) for doing so.

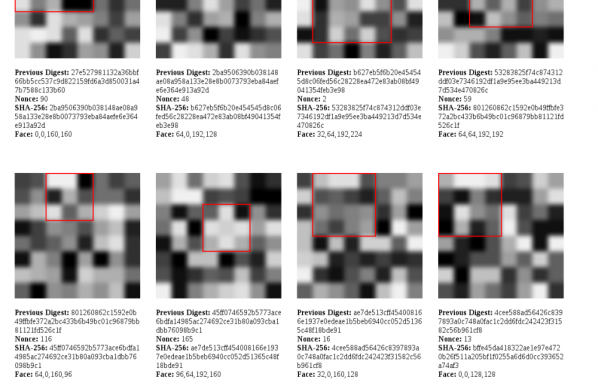

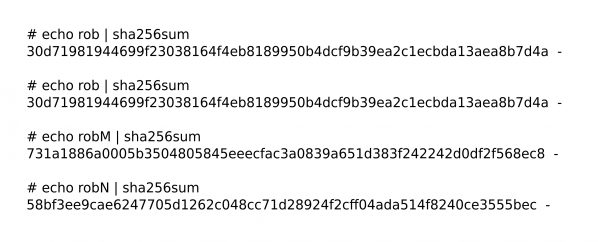

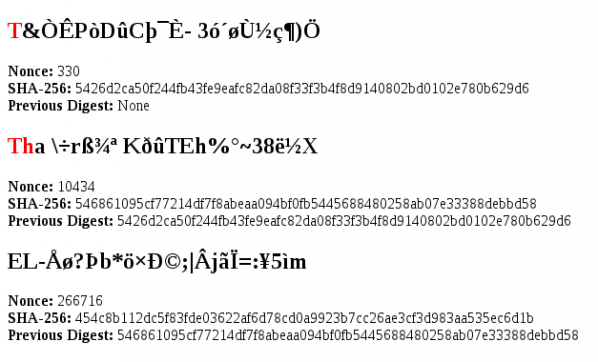

Bitcoin account addresses, Bitcoin transactions, and the proof of work system all use cryptographic algorithms. These are mathematical ways of taking data and creating an almost un-fakeable, almost un-reversable, almost unique (where “almost” means “as likely to fail as the Earth is likely to be hit by a civilization-ending asteroid in the next 20 minutes”) identity for it. The examples here show how feeding a cryptographic hash function the same data twice results in the same incredibly unlikely number, but feeding it even slightly different data results in very different and unrelated numbers.

Bitcoin uses these functions to secure its network in the “proof of work” system by searching for auspicious numbers in their output (strings of zeroes in the current scheme). My Facecoin (2014) implements an alternative proof of work system in which the useless work performed is that of portraiture, (mis-)using machine vision algorithms to find imaginary faces in cryptographic hashes represented as bitmaps rather than numbers.

My Monkeycoin (2014) takes a different approach, searching for the complete works of shakespeare in textual representations of those numbers.

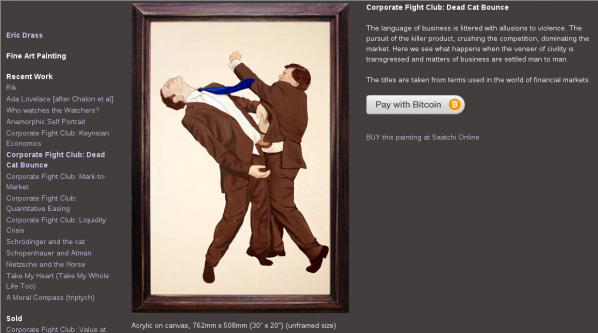

Cryptocurrencies can be used in lieu of fiat currency for all kinds of transactions, including artistic ones. Here the artist Eric Drass is offering a painting for sale via Bitcoin. Different means of exhange create different kinds of social relationships, buying the painting via Bitcoin is a different kind of social and economic transaction than paying with fiat currency for it via Saatchi Online.

Cryptocurrencies can be created as complimentary currencies with specific intent or for specific constituencies. This is the logo of Banksycoin (2014), an attempt to create a currency to pay for art and create a parallel economy for artistic production.

Cryptocurrency-based technology can change how individual artworks are owned as well as paid for. This is theironman’s “nxtdrop” (2014), the ownership of which is represented by shares on the “nxt” blockchain. Ownership of the painting can be changed fractionally by dealing in those shares.

There are poems, images, and other cultural artefacts embedded in the Bitcoin blockchain, disguised as transaction information. I embedded the cryptographic hash of my genome in the Bitcoin blockchain to establish my identity with “Proof Of Existence I” (2014).

This is Caleb Larsen’s “A Tool To Deceive and Slaughter” (2009). It contains a computer that must be connected to the Internet as part of the conditions of ownership, which then immediately offers itself for sale on the eBay auction site. This kind of “smart property” is a good example of smart contracts, in which arrangements such as ownership are managed by software rather or more immediately than by law.

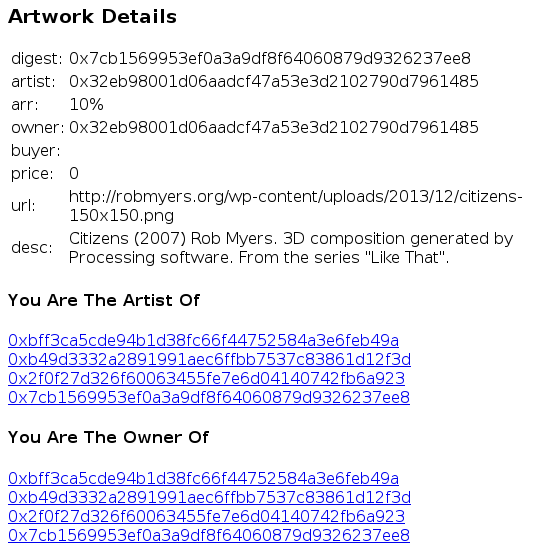

My “Art Market” (2014), uses the Ethereum smart contract system (a generalization of Bitcoin to contracts other than for the exchange of money) to record “owenrship” of infinitely reproducible digital files and allow them to be “sold” for cryptocurrency. Other systems exist to do this, such as the Monegraph and Rarebit systems.

My “Is Art” (2014) uses a simple smart contract to democratize the nominational strategy of conceptual art. The contract can be set to nominate itself as art or not with a click of a mouse and the paying of a small fee to execue the change on the blockchain.

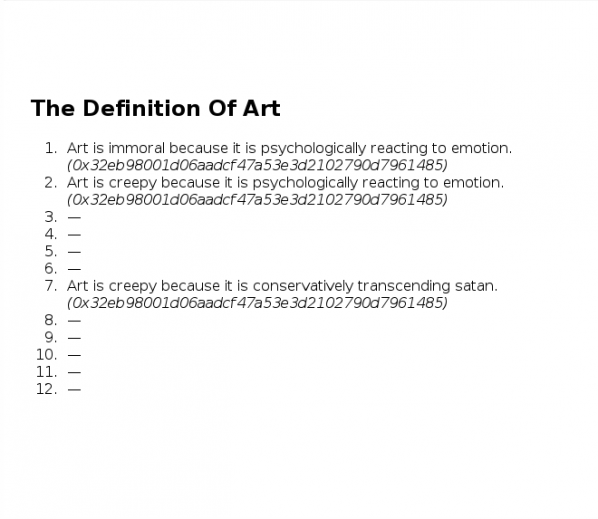

My “Art Is” (2014) applies behavioural economics to the philosophy of art, allowing individuals to pay as much as they feel their definition of art it worth. This disincentivises malicious or unserious definitions and indicates an individuals’s confidence in their definition, using market mechanisms to price and allocate knowledge and even truth efficiently. fnord