Information wants to be free, and net art is information. Trying to make it harder to copy is like trying to make water less wet. Or perhaps like trying to give it a soul. In “Blockchain Poetics” I described “new kinds of quasi-property” created using the Blockchain as a mis-application of that technology. Ken Wark is similarly unimpressed – “My Collectible Ass“, he complains in e-flux.

The history of Conceptual Art’s dematerialization of the art object shows that the art market loves nothing more than finding ways to make the previously unsaleable into financial assets. As Wark points out, “We tend to think that what is collected is a rare object.” There’s nothing rarer than something that doesn’t actually exist. But the un-ownable and non-or-barely-existent can be represented as property by proxy objects. Financial elsewheres rather than financial futures.

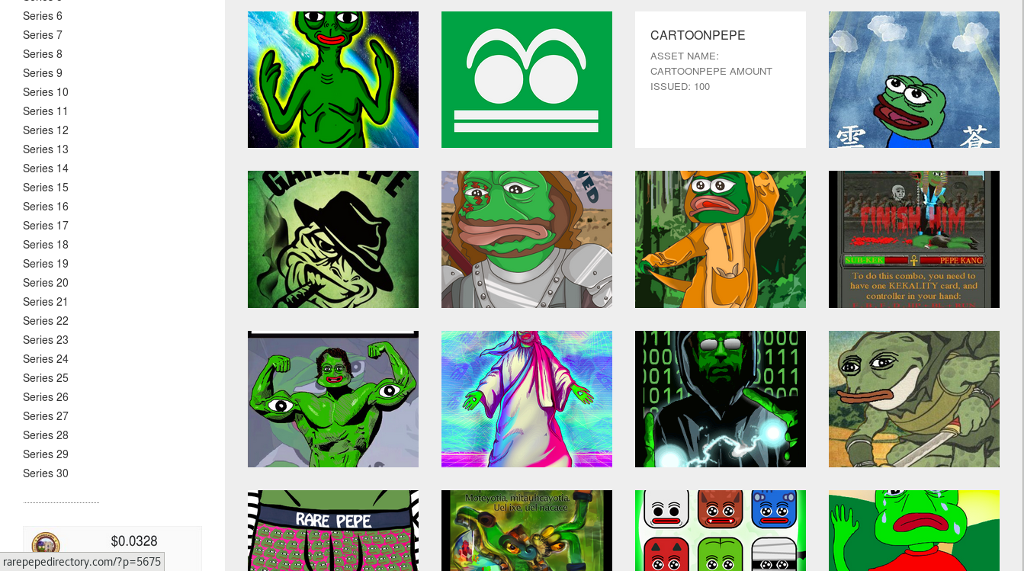

Cryptographic tokens are a generalization of cryptocurrency to represent assets other than money. Such as editions of digital artworks. Wark’s criterion of rarity is reflected in the name of the most successful crypto-token collectibles – “Rare Pepes” are detournements of the “Pepe The Frog” character (previously appropriated by the alt.right) that are sold as CounterParty tokens. CounterParty is a system layered on top of Bitcoin’s blockchain that allows the creation of new tokens with varying properties (different issuance amounts, subdividable or not, locked for further issuance or not, a sub-token of another token) which can then be exchanged and transferred backed by the security of the Bitcoin blockchain. It’s an older system than Ethereum or other platforms that are now used for tokens. It has few major use cases, and Rare Pepes are one of them.

To make a Rare Pepe card you create a CounterParty token with a reference to the image you are using in its metadata, issue as many tokens as you are going to, then lock the token so no more can be issued (making the token “rare”). Rare Pepe quantities, prices and styles vary. There are magazines and virtual galleries devoted to them. There is even a subtoken representing the original physical version of one image (with an edition size of one).

A more singular set of images are the “CryptoPunks” (seen at the top of this page), which exist as an ERC20 token (almost) on the Ethereum blockchain. The “smart contract” that administers the token contains a cryptographic hash of an image of 10,000 bitmapped characters which can be bought and sold using its functions. Like Rare Pepes, the punks have a lighthearted style (they are retro pixellated avatars) and have varying rarity (some features are unique, others appear on dozens of characters) . Unlike Rare Pepes, every punk was created at the start of the project and no more can be added. At the time of writing, punks are available to purchase for 0.12 to 1,010,101,101,110,010,011,000.01 ETH (40.35 to 339,616,193,448,241,111,336,826.06 USD).

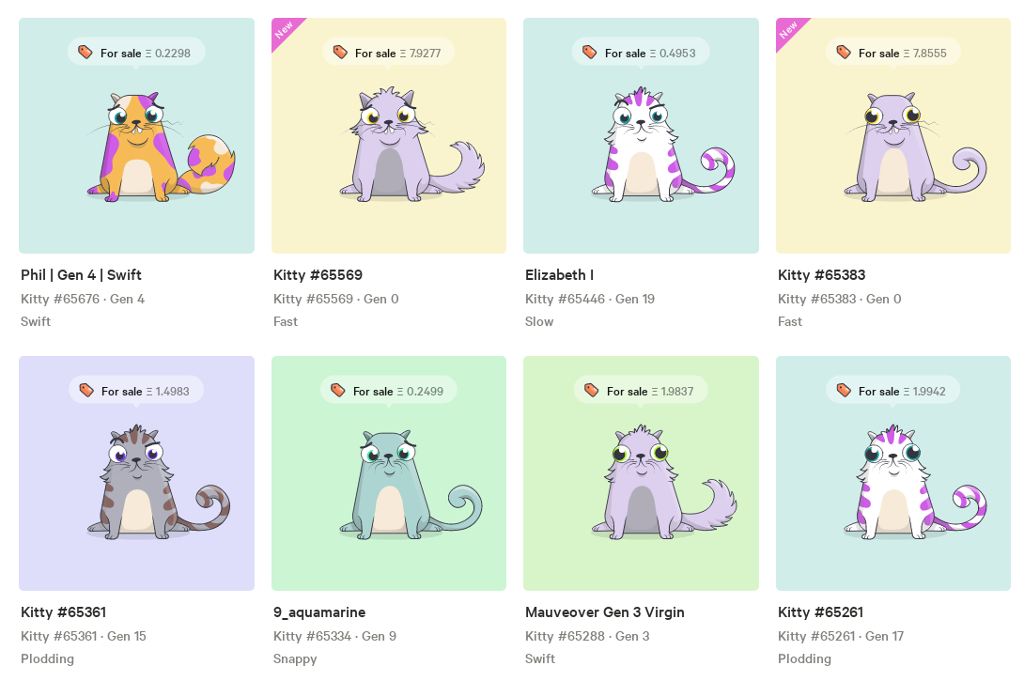

An even more playful approach may be able to take artificially scarce digital collectibles mainstream. CryptoKitties are customized cartoon cats whose appearance is determined by a digital genome (like the old “Cabbage Patch Kids” dolls) that can be interbred to produce more of them (like William Latham’s “Mutator”). At the time of writing they are taking up 13% of the Ethereum network’s capacity, making them the single biggest user of that blockchain, and the most expensive has sold for more than 100,000USD.

Every art is relative to a culture and an economy, whatever its other properties. The ground that tradeable blockchain images are a figure against is a particular moment in the history of cryptocurrency. Trading cards and digital collectibles fit a specific cultural niche, as does their iconography and the socially performative act of dealing in them. Their price may reflect the ability of cryptocurrency early adopters (who in the case of CounterParty and its XCP currency don’t have much else to spend it on) to be more extravagant with their hodlings.

“dada.nyc” follows the tokenized image edition strategy but applies it to popular/illustration art. Again each image is available for a given price in a given edition (for example 0.084 ETH in an edition of 150). The gallery takes a cut, and it takes a cut on profits on the secondary market. It also gives a cut to the artist, simulating Droit de Suite/Artist’s Resale Right. The Resale Right is controversial – it breaks the first sale doctrine and mostly benefits the estates of dead famous artists. But I implemented it as a user-settable property in the Art Market smart contract that I wrote in 2014 as I felt it was worth experimenting with in a voluntary setting.

Monegraph came out while I was working on that project. Like Ascribe it is a serious digital art registry implemented initially using pre-smart-contract technology (NameCoin for Monegraph, Bitcoin for Ascribe). These platforms’ seriousness and phrasing as registries contrasts with the playfulness and explicit tokenizaton of more recent systems. This and the already mentioned possible impacts of the social and economic impact of the increase in value of cryptocurrencies since 2014, along with the increased mainstream awareness of cryptocurrency, may explain the difference in their adoption (or at least their place in the hype cycle).

In contrast, Maecenas is a tokenized investment fund for physical fine art. It operates in part like the scene in William Gibson’s “Count Zero” (1986) in which Marly, one of the protagonists, reflects on how art in the mid-21st century is bought and sold as “points” in the work of a particular artist that represent shares in the value of the “originals” which are stored unseen in a vault. To quote their web site, “investors speculate via synthetic exposure: James is a Modern Art collector who needs to finance the purchase of a new Jeff Koons sculpture worth $120k. Instead of selling items from his collection, or getting an expensive loan, James get the required funding by listing in Maecenas 20% of one of his flagship pieces of art. Access to Maecenas is via an ERC20 token named (ART)” that Maecenas claim will improve access, transparency and fairness in the art market.

Propertization, fractionalization and financialization via proxy tokens (we cannot “own” allographic digital images, or own part of autographic paintings without dismembering them, but we can own tokens that we agree to pretend represent these things) promise to support art production using the economic accident of the value of cryptocurrency going to the moon. Quasiproperty without attempts at the costly fantasy of imposing access control via DRM is a form of, or a variation on the idea of, patronage. I feel this complex of ideas should be more useful to critics of the commodity form and capitalism than it has generally been treated as so far. If we still wish to take the opposite tack this leads us to the gift economy or the commons. Copyright is the default state for most art when it is created and is being increasingly restrictively enforced on the net. Opposing it passively or actively through alternative copyright licensing can perform a critique of this and keep space open for alternatives. These strategies needn’t exclude each other though.

If you are familiar with DAOs, you can see how a system similar to these could become a self-supporting, self-curating DAO. Plantoid is an example of a singular artwork (or family of artworks) produced and exhibited in such a way. Imagine it generalized to a gallery or a participatory art show, a DAO that lets you do art with others, a DAOWO.

These technologies can provide objects for critical exploration that evoke wider contemporary themes. They can function as tools and resources for the creation of art and its social collectivities focussing on these and other themes. Within the existing economy they can provide ways of supporting the arts (as many of the projects mentioned above claim to), which should neither be dismissed reflexively nor accepted without irony. Or they can be used to try to bootstrap a different context entirely, even if only briefly or in the imagination. The various modes of tokenization represent potential ways of making a living in, critiquing, or even transforming the artworld in an era of the continuing expansion of the sphere of private property and financialization under technocapital.