Part of the NEW WORLD ORDER exhibition at Furtherfield Gallery

BOOKING ESSENTIAL – Limited places available for this FREE workshop

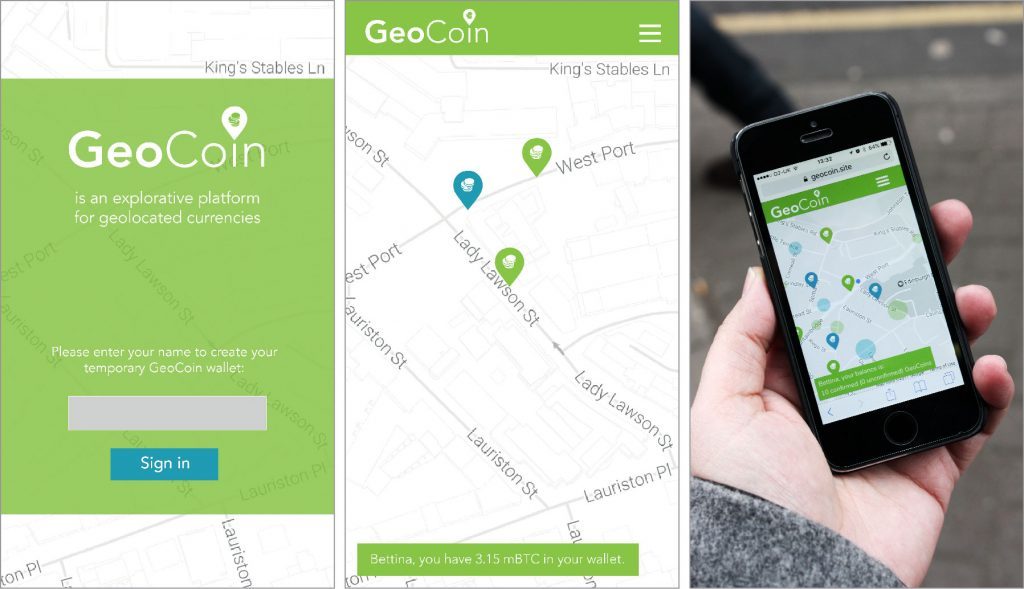

A day of design-based research using the GeoCoin platform to explore novel ways of reconsidering and reinventing currency through location-specific value transactions. How can money be reprogrammed to interact with or react to everyday practices of value exchange in and around the city? Explore these and more questions with the Design Informatics team from the University of Edinburgh.

This workshop is part of the ESRC funded research project After Money lead by Design Informatics at the University of Edinburgh.

Saturday 24 June, 11-1pm and 2-4pm, Furtherfield Gallery

Ever wanted to join your partner in bitcoin matrimony? Or wanted to join another partnership for a short time only? You’ve come to the right place. For this day only, you can record your short-term bitcoin union via Handfastr on the blockchain in an immutable and ever growing ledger of bitcoin marriages at the Furtherfield Gallery.

This project is part of the ESRC funded research project After Money lead by Design Informatics at the University of Edinburgh.

Several months ago I stayed in an offbeat Amsterdam hotel that brewed its own beer but refused to accept cash for it. Instead, they forced me to use the Visa payment card network to get my UK bank to transfer €4 to their Dutch bank via the elaborate international correspondent banking system.

I was there with civil liberties campaigner Ben Hayes. We were irritated by the anti-cash policy, something the hotel staff took for annoyance at the international payments charges we’d face. That wasn’t it, though. Our concern was intuitive about a potential future world in which we’d have to report our every economic move to a bank and the effect this could have on marginalised people.

‘Cashless society’ is a euphemism for the “ask-your-banks-for-permission-to-pay society”. Rather than an exchange occurring directly between the hotel and me, it takes the form of a “have your people talk to my people” affair. Various intermediaries message one another to arrange an exchange between our respective banks. That may be a convenient option, but in a cashless society, it would no longer be an option at all. You’d have no choice but to conform to the intermediaries’ automated bureaucracy, giving them a lot of power and a lot of data about the microtexture of your economic life.

Our concerns are unfashionable. Without any explicit declaration, the War on Cash has begun. Proponents of digital payment systems are riding upon technology-friendly times to proclaim the imminent Death of Cash. Sweden leads in the drive to reach this state, but the UK is edging that way too. London buses stopped accepting cash in 2014 but do accept MasterCard and Visa contactless payment cards.

Every cash transaction you make is one that payments intermediary like Visa takes no fee from, so it has an interest in making cash appear redundant, deviant and criminal. That’s why, in 2016, Visa Europe launched its “Cashfree and Proud” campaign to inform cardholders that “they can make a Visa contactless payment with confidence and feel liberated from the need to carry cash.”

The company’s press release declared the campaign “the latest step of Visa UK’s long-term strategy to make cash ‘peculiar’ by 2020.”

There you have it. An orchestrated strategy to make us feel weird about cash. Propaganda is a key weapon of war, and all sides present themselves as liberators. Visa comes across like a paternalistic commander when assuring us that we – like a baby taking first steps – will feel a sense of achievement at liberating ourselves from the burden of cash dependence. Visa technology offers freedom without dependence or dangers.

Other propagandists join Visa. In 2014 Penny for London arrived, an apparently altruistic group set up by the Mayor’s Fund for London and Barclaycard, using charity as a hook to switch people to contactless cards on the London Underground. PayPal plastered cities with billboards claiming that “new money doesn’t need a wallet”, and a video proclaiming: “New money isn’t paper, it’s progress”. Astroturfing campaigns like No Cash Day are backed by American Express, highlighting such anti-cash themes as the environmental impact of banknotes. Other tactics include pointing out that criminals use cash, that it fuels the shadow economy, that it’s unsafe, and facilitates tax evasion.

These arguments have notable shortcomings. Criminals use many things we keep – like cars – and fighting crime doesn’t prioritise maintaining other social goods like civil liberties. The ‘shadow economy’ is a derogatory term used by elites to describe the economic activities of people they neither understand nor care about. As for safety, having your wallet cash stolen pales compared to having your savings obliterated in a digital account hack. And if you care about tax justice, start with the mass corporate tax avoidance facilitated by the formal banking sector.

However, the peculiar feature of this war is that only one side is fighting. Very few media champions defend cash. It is like a taken-for-granted public utility, whereas digital payment platforms are run by private companies with an incentive to flood the media with their key messages. When they fight this war, their target is our cultural belief in cash and the belief that its provision should be a public right.

The UK government does not plan to maintain that right and is siding with the payments industry. Their position is summed up by economist Kenneth Rogoff in his new book The Curse of Cash. He argues that, apart from facilitating crime and tax evasion, cash hampers central banks from setting negative interest rates. In the absence of cash, everyone must keep their money in the form of digital bank deposits. During recessions, central banks could then use the banking system to deliberately corrode people’s deposits via negative charges, ‘inspiring’ them to spend rather than hoard.

The emergent consensus among economic and political elites is that this is the direction to go in, but to manufacture consent for this requires a drip-drip erosion of public resistance. Hearts and minds must be shown that the change represents inevitable and desirable progress.

Anyone defending cash in this context will be labelled as an anti-progress, reactionary, and nostalgic Luddite. That’s why we must not defend cash. Rather, we should focus on pointing out that the Death of Cash means the Rise of Something Else. We are fighting a broader battle to maintain alternatives to the growing digital panopticon that is emerging all around us.

To understand this conflict, we must step back. A monetary transaction involves exchanging specific goods or services for tokens giving access to general goods and services from others. The pub landlord hands me a beer at night if I transfer tokens that allow him to get cigarettes from a shopkeeper in the morning.

There are two ways to implement this, though.

The first is to give the tokens a physical form. In this scenario, ‘getting rich’ means accumulating those physical things and ‘making a payment’ means handing them over to someone else. They are bearer instruments, which means nobody keeps a record of who owns them. Rather, whoever holds them owns them. This is your wallet with notes in it. This is cash.

Alternatively, you can use a ledger. Someone sets up a database with spaces allotted to different people. This is then used to keep a record of who has tokens. These tokens have no physical form but are written into existence. They are ‘data objects’ and are ‘moved around’ by editing the record. The keeper of the ledger thus maintains an account of what money is attributable to you, ‘keeping score’ of it for you. In this system, ‘getting rich’ means accumulating a high score on your account. ‘Making a payment’ involves identifying yourself to the keeper of the ledger via a communications system and requesting that they edit your account and the account of whoever you are paying.

Does this sound familiar? It is your bank account.

Old banks used actual books to maintain these account ledgers, but modern banks use digital databases housed in huge data centres. You then interact with them via your internet banking portal, your phone app, or by going into a branch. This is not a minor part of the monetary system. Over 90 per cent of the UK’s money supply exists nowhere but on bank databases.

It is upon this underlying infrastructure that payment card companies like Visa build their operations. They deal with situations in which someone with one bank account finds themselves in a shop owned by someone else with another bank account. Rather than the pub landlord giving me his bank details for a manual transfer, my card sends messages through Visa’s network to automatically arrange the editing of our respective accounts.

Many fintech – financial technology – startups specialise in finding ways to augment, gamify or streamline elements of this underlying infrastructure. Thus, I might use a mobile phone fingerprint reader to authorise changes to the bank databases. – ‘disruption’ merely involves putting slicker clothes on the same old emperor.

The use of high-speed communications systems to rearrange binary code information about who has what money might be new, but ledger money is as old as any bearer form. The Rai stones of the island of Yap were huge and largely unmovable stones that, while seeming like physical tokens, were a form of ledger money. Rather than being physically moved – like cash would – a record of who owned the stones was kept in people’s heads, stored in their communal memory. If the owners wished to ‘transfer’ a stone to another, they ‘edited the ledger’ of who possessed the tokens by merely informing the community. Why physically roll the stone if you can get everyone to remember that it has ‘moved’ to somebody else? The main reason that we struggle to recognise this as a form of cashlessness is that the ledger is invisible and informal.

Cashless society, though, is presented as futuristic progress rather than past history, a fashionable motif of futurists, entrepreneurs and innovation gurus. Nevertheless, while there are real trends in behaviour and tastes to be spotted in society, there are also trends in behaviour and taste among trend-spotters. They are paid to fixate upon change and have the incentive to hype minor shifts into ‘end of history’ deaths, births and revolutions. Innovation communities are always at risk of losing touch within an echo chamber of buzzwords, amplifying one another’s speculations into concrete future certainties. These prediction factories always produce the same two unprovable sentences: “In the future we will… ” and “In the future, we will no longer… “. Thus, in the future, we will all use digital payments. In the future, we will no longer use cash.

This is the utopia presented by the growing digital payments industry, which wishes to turn the perpetual mirage of a cashless society into a self-fulfilling prophecy. Indeed, a key trick to promoting your interests is to speak of them as obvious inevitabilities already underway. It makes others feel silly for not recognising the apparently obvious change.

To create a trend, you should also present it as something others demand. A sentence like “All over the world, people are switching to digital payments” is not there to describe what other people want. It’s there to tell you what you should want by making you feel in sync with them. Here’s fintech investor Rich Ricci invoking the spectre of millennials, with their strange moral power to define the future. They are repulsed by the revolting physicality of cash and feel all warm towards fintech gadgets. But these are not, on the whole, real people. They are a weapon in the arsenal of marketing departments to make older people feel prehistoric. We’re not pushing this. We’re just responding to what the new generation demands.

And so we get Visa’s Cashfree and Proud campaign. If people really were ashamed of cash, they wouldn’t need ads to tell them. Visa must engineer that shame to teach you that what you want is the same as what they want. And if you don’t want it, just remember that a cashless society is inevitable. Don’t get left behind.

But this system will leave many behind. It is hardwired to include only those with access to a bank account, and bank accounts are hosted by profit-seeking corporations that operate at scale. They have no time for your individual idiosyncrasies. They cannot make a profit off anyone who cannot easily be categorised and modelled on a spreadsheet.

So, good luck if you find yourself with only sporadic appearances in the official books of state, if you are a rural migrant without a recorded birthdate, identifiable parents, or an ID number. Sorry if you lack markers of stability if you are a rogue traveller without a permanent address, phone number or email. Apologies if you have no status symbols or are an informal economy hustler with no assets and low, inconsistent income. Condolences if you have no official stamps of approval from gatekeeper bodies, like university certificates or records of employment at a formal company. Goodbye if you have a poor record of engagements with recognised institutions, like a criminal record or a record of missed payments.

This is no small problem. The World Bank estimates that there are two billion adults without bank accounts, and even those who do have them still often rely upon the informal flexibility of cash for everyday transactions. These are people bearing indelible markers of being incompatible with formal institutional space. They are often too unprofitable for banks to justify the expense of setting them up with accounts. This is the shadow economy, invisible to our systems.

The shadow economy is not just ‘poor’ people. It’s potentially anybody who hasn’t internalised the correct state-corporate narrative of normality and anyone seeking a lifestyle outside of the mainstream. The future presented by self-styled innovation gurus has no scope for flexible, unpredictable or invisible people. They represent analogue backwardness. The future is a world of endless consumer choice built upon an inescapable digital uniformity of automated rules, a matrix outside which you can neither exist nor think.

Back in Amsterdam, I hang out with Ancilla van de Leest of the Netherlands Pirate Party. She only visits establishments that accept cash, true to her political belief in individual privacy from prying eyes.

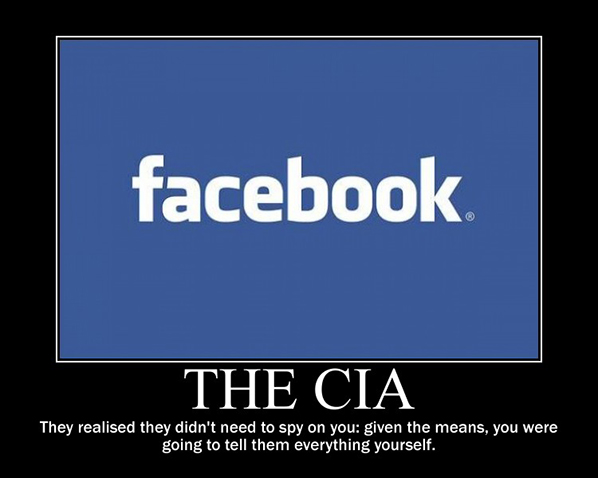

However, it would be wrong to assume that Ancilla’s primary concern involves surveillance by a Big Brother-style bogeyman. It’s true that your spending patterns reveal much about how you actually live, and the privacy implications of having these recorded in searchable database format are only starting to be uncovered. We know that targeted individual surveillance of payments occurs by the likes of the FBI and NSA, but routinised mass surveillance could become a norm. Imagine automatic flagging systems triggered by anyone engaging in a combination of transactions deemed subversive. Tax authorities are bound to be building systems to flag discrepancies between your spending patterns and your declared profits.

It’s also true that at London fintech gatherings, the exciting visions of a cashless society occasionally come with a disclaimer that we should think about the power granted to those who control the system. Not only can payment intermediaries see every time you buy access to a porn site, but they have the ability to censor your transactions, like Visa, PayPal and MasterCard attempting to choke WikiLeaksby refusing to process people’s donations. We could imagine some harsh sci-fi scenario in which a theocratic regime issues decrees to payment processors to block anyone buying books deemed sexually deviant. Such decrees could be automatically enforced via code, with subroutines remotely triggering smart locks to place the offending miscreant under house arrest while automatically deducting a fine from their account.

Such automated dystopias should ideally be avoided, so a dose of paranoia about digital payment systems is a healthy impulse, even if it might be unwarranted.

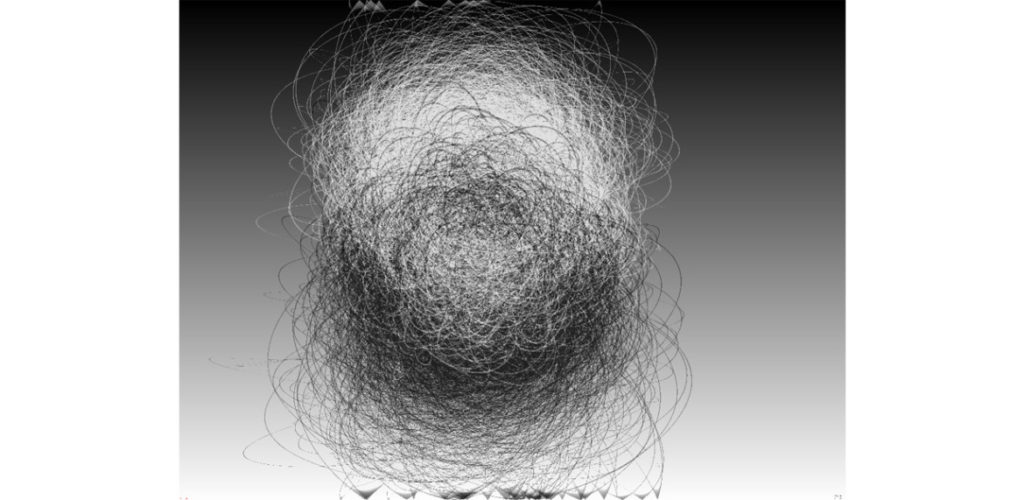

But that isn’t really the point. What’s more important to Ancilla and me is the looming sense of an external watcher that ‘assists’, ‘guides’ or ‘helps’ you in your life, tracking and logging your moves to influence you. The watcher is not a single entity. It’s a collective array being incrementally built in stages by startups and companies worldwide as we speak. We feel it seeping deeper into our lives, a mesh of connected devices, cookies and sensors. Whether we visualise it as the benevolent eyes of a parent or the menacing eyes of a tyrant doesn’t matter. The point is that the eyes have the potential to monitor you all the time.

The proclaimed Death of Cash is thus an episode in the broader drama that is the Death of Privacy, the death of the breathing room, and the death of informal, non-measured, unaccounted-for behaviour. Every action you take must forever be attached to your digital persona, dragging a data trail extending back to the day you were born. We face creating an entire generation of people who do not know what it feels like not to be monitored.

For many economists, the War on Cash will be resolved by their favourite mystical demigod, the market. This guiding force prevails when utility-maximising producers and consumers make rational choices with perfect information about their options and total freedom to choose whether or not to exercise them. If digital payment transaction costs are lower, then the cash will rightly die.

The pristine realm of market theory is unfit to assess the dynamics of this situation. Our sense of what constitutes a legitimate choice does not form in a vacuum. We are born into social power structures that tell us what normality is and shame us for not choosing ‘correctly’. You might be a rebel who challenges prevailing cultural norms, but those norms are conditioned by those with the greatest financial and media clout. At this moment, the blaring of propaganda extolling the short-term conveniences of digital payment is dulling our critical impulses to rearrange our cultural DNA. Who is thinking about the longer-term implications of building our lives around these systems and thereby locking ourselves into dependence upon them?

Unlike a battle fought using violence, hegemony is the assertion of power by getting people to believe in it, to see it as inevitable, unassailable and normal. Visa’s four-year plan is one such exercise, and once we’ve internalised it, we’ll choose to build their power. We’ll feel strangely comforted by the MasterCard billboard endorsed by the Mayor of London. We’ll find ourselves downloading ApplePay like a dazed child accepting a gift.

So, let’s prepare for the War on Cash. Remember, this is not about romanticising the £10 notes with the Queen. This is about maintaining alternatives to the stifling hygiene of the digital panopticon being constructed to serve the needs of profit-maximising, cost-minimising, customer-monitoring, control-seeking, and behaviour-predicting commercial bureaucrats. And fear not, the Germans are onside, along with the criminals, the homeless, the street-side buskers and an army of people whose lives will never get a five-star rating on a mainstream reputation scoring system. We will forge alliances with purveyors of non-bank alternative currency systems and maintain the option to use our payment cards. Because what we fight for is precisely that. The option.

French artists Émilie Brout and Maxime Marion contribute three pieces to The Human Face of Cryptoeconomies exhibition. Gold and Glitter is a painstakingly assembled installation of collaged GIFs. Previous installations have featured the GIFs displayed on a gold iPad atop a pile of collected gold trinkets; at Furtherfield Gallery now a single golden helium balloon hovers in front of a floor to ceiling projection. Nakamoto (The Proof) is video documentation of the artists’ efforts to try and place a face on the elusive Bitcoin creator, Satoshi Nakamoto (but is it his face in the end? We don’t know). Untitled SAS is a registered French company without employees and whose sole purpose is to exist as a work of art.

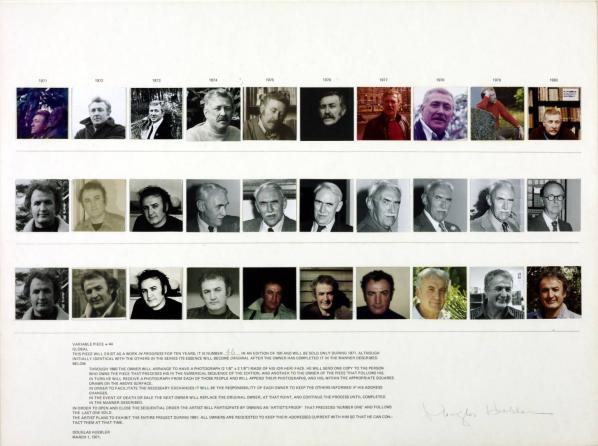

Brout and Marion’s work can be situated among artists and art practices who have grappled with how to think about value and objects—or more precisely, how objects are inscribed (and sometimes not) into an idea of what is valuable. In a recent article for Mute Magazine, authors Daniel Spaulding and Nicole Demby point out that “Value is a specific social relation that causes the products of labor to appear and to exchange as equivalents; it is not an all-penetrating miasma.”1 Value is a process by which bodies are sorted and edited but it is not a default spectrum on to which all bodies must fall in varying degrees. This clarification makes explicit the fact that while the relationships productive of value allow “products of labor to appear and to [be exchanged]”2 this is not an effect that is extended to all products of labor. Attempts to isolate the underlying logic of this sorting mechanism are often at the heart of art practices dealing with questions of value and commodification. Like Andy Warhol’s Brillo Boxes or Marcel Duchamp’s Fountain, these artworks become interesting problematics for the question of art and value for the ways in which they are able to straddle two economic realms—that of the art object and the commercial object—while resisting total inclusion in either.

The Human Face of Cryptoeconomies picks up these themes in an art context and repositions them alongside digital cultures and emerging digital economies. In Brout and Marion’s work alone, concepts of kitsch, identity, and human capital have been inhabited and imported from their originary realms into the digital. Answering questions remotely, Brout and Marion were kind enough to give us some insights into their work and process. My goal here has been to draw out some points about the operation of value that are at work in Brout and Marion’s practice, as well as to point towards an idea of how value is transformed, or even mutated, in the digital age.

* * *

Brout and Marion open up with an interesting provocation. They explain, “When we showed the project [Glitter and Gold] in Paris this year, people stole a lot of objects, even if they were very cheap. Gold has an incredible power of attraction.”

It is telling, to some extent, that Brout and Marion’s meditations on gold have an almost direct link to the visual metaphor used by Clement Greenberg in his 1939 essay Avante-Garde and Kitsch to describe the relation between culture—epitomized in the avant-garde—and the ruling class. Greenberg writes, “No culture can develop without a social basis, without a source of stable income. And in the case of the avant-garde, this was provided by an elite among the ruling class of that society from which it assumed itself to be cut off, but to which it has always remained attached by an umbilical cord of gold.”3 This relation is subverted in Gold and Glitter, which takes for its currency—its umbilical cord of gold—a kind of unquantifiable labor that is seemingly (and perhaps somewhat sinisterly) always embedded in discussions of the digital.

For Greenberg, kitsch always existed in relation to the avant-garde; one fed and supported the other, even if the way in which that relation of sustenance worked was by negation. And while Greenberg’s theory relies on his own strict allegiances to hierarchical society, privileged classes, the values of private property, and all the other divisive tenets of capitalism that we now know all too well can be destructive. Kitsch remains useful to us for the ways in which it allows the means of production to enter into a consideration of aesthetics. Here the recent writing of Boris Groys can be useful. In an essay written for e-flux titled Art and Money, Groys makes a compelling case for why we should persist in a sympathetic reading of Greenberg. He argues that Greenberg’s incisions amongst the haves and have nots of culture can be cut across different lines; that because Greenberg identifies avant-garde art as art that is invested in demonstrating the way in which is it is made and it doesn’t allow for its evaluation by taste. Avant-garde art shows its guts to us all, and on equal terms—“its productive side, its poetics, the devices and practices that bring it into being” and inasmuch “should be analyzed according the same criteria as objects like cars, trains, or planes.”4

For Groys this distinction situates the avant-garde within a constructivist and productivist context, opening up artworks themselves to be appreciated for their production, or rather, “in terms that refer more to the activities of scientists and workers than to the lifestyle of the leisure class.”5 In this way Glitter and Gold, like Brout and Marion’s other artworks, is to be appreciated not for any transcendent reason but rather for the means by which it came into existence. ‘The processes of searching and collaging golden GIFs sit side by side with the physical work of accumulating the golden trinkets for display: “We collected these objects for a long time” the artists explain, “some were personal objects (child dolphin pendant, in true gold), others were given or found in flea markets, bought in bazaars … We wanted to have a lot of different types and symbols, from a Hand of Fatima to golden chain, skulls, butterflies, etc.”

Furthermore, Glitter and Gold can be understood as the product of compounding labors: the labor of Brout and Marion in collecting their artifacts, the labor necessary to create the artifacts, the labor of GIF artists, the labor of searching for said GIFs, the labor of weaving a digital collage. These on-going processes forge, trace, and re-trace paths during which, at some point, gold takes on the function as aesthetic shorthand for value. As Brout and Marion explain, “Here the question is more about the intrinsic values we all find in Gold, even when it just looks like gold. Gold turns any prosaic product into something desirable. [Gold and Glitter] is less about economics than about perceived value.”

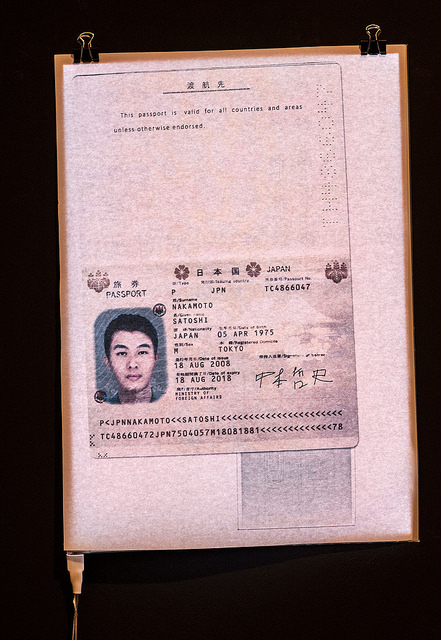

Groys provides his reading of Greenberg as a means of pointing towards a materiality that is always in excess of existing coordinates of value. If value always reveals the products of labor as they enter into a zone of exchange, it is something else proper to contemporary art that reveals another materiality beyond this exchange. For Groys, this something else is at work in the dynamics of art exhibition, which can render visible otherwise invisible forces and their material substrates. This is certainly a potential that is explored by Brout and Marion. In Nakamoto (The Proof), the viewer can watch the artists’ attempt at creating a passport for the infamous and elusive Bitcoin creator Satoshi Nakamoto. At present, it is unclear whether Nakamoto is a single person or group of people, though the Nakamoto legacy as creator of Bitcoin, a virtual currency widely used on darknets, is larger than life. Adding to this myth, after publishing the paper to kickstart bitcoin via the Cryptography Mailing List in 2008, and launching the Bitcoin software client in 2009, Nakamoto has only sporadically been seen participating in the project with others via mailing lists before making a final, formal disappearance in 2011, explaining that he/she/they had “moved on to other things.”6 Nakamoto’s disappearance, coupled with the fact that Nakamoto’s estimated net worth must be somewhere in the hundred millions Euros, has given rise to the modern-day myth of Nakamoto, and with it an insatiable curiosity to uncover the identity and whereabouts of the elusive Bitcoin creator.

Brout and Marion make their own attempt to summons the mysterious Nakamoto back to life by putting together the evidence of Nakamoto’s existence and procuring a Japanese passport using none other than the technologies that Nakamoto’s Bitcoin both imparted and facilitated. When asked if they feared for their own self-preservation in seeing this project through, Brout and Marion answered, “Yes, even if we were pretty sure that it would be easy to prove our intention to the authorities, and that the fake passport couldn’t be useful to anybody, buying a fake passport is still illegal.” They add, “But we also wanted to play the game entirely, so we made every possible effort to preserve our anonymity during our journey on the darknets.”

However Brout and Marion have yet to receive the passport; as they explain, “The last time we received information, the document was in transit at the Romanian border.” When asked if they expect to receive the passport, they respond, “No, today we think we will never receive it. We are completely sure that it has existed, but we’ll surely never know what happened to it.” What, then, will they do if they never receive the passport? “Maybe just continue to exhibit the only proof of it we have!” they exclaim. “There is something beautiful in it: we tried to create a physical proof of the existence of a contemporary myth, using digital technology and digital money, and the only thing we have is a scan!”

If Brout and Marion’s nonchalance seems unexpected then it is because the disappearance of the passport for the artists marks just another ebb in the overall flow of their piece; a flow that began with Nakamoto, coursed through their clandestine chats via a Tor networked browser and high security email, and now continues to trickle on while we wait in anticipation for the next chapter of the Nakamoto passport to reveal itself. In this respect, the anticipation of the passport is a poetic and unforeseen layer added to the significance of the piece: “Maybe it is even better [that the passport should not arrive]” Brout and Marion comment. “It’s like it was impossible to bring Nakamoto out of the digital world.”

If value is always formed by way of a social relation, then how do digital modes of sociality also deliver this effect? This becomes a particularly fraught question when considering that, as Anna Munster has written, the sociality that takes place on the internet can be understood as the interrelation of any number of subjectivities, both organic and inorganic. Brout and Marion’s ambivalence to the purloined passport highlights just such an expectation: “Here the lack of identity delivers a lot of value. Look at Snowden: journalists ask him more about his girlfriend than about his revelations. Making something as big as Bitcoin and staying perfectly anonymous? These are strong attacks to two of the most important issues of our societies: banks and privacy.” What their statement suggests is how a collective movement towards transgression, here seen as compounding maneuvers of avoidance of physical world boundaries and institutions, might hold within it the promise of its own set of value coordinates. As Brout and Marion further explain: “For us, Nakamoto is absolutely fascinating. The efforts he made to prevent himself from being turned into a product are incredible. Especially when you know the importance of [Bitcoin’s] creation, and that only a few men in the world are smart enough to create something like this. Adding to that the fact that Nakamoto is probably a millionaire, you have one of the only true contemporary myths, something hard to find credible even if it was just a fictional character in a movie. So this somewhat absurd attempt to create a proof of Nakamoto’s existence was, for us, an attempt to make a portrait of him, to put light on his figure. And, in some ways, a tribute.”

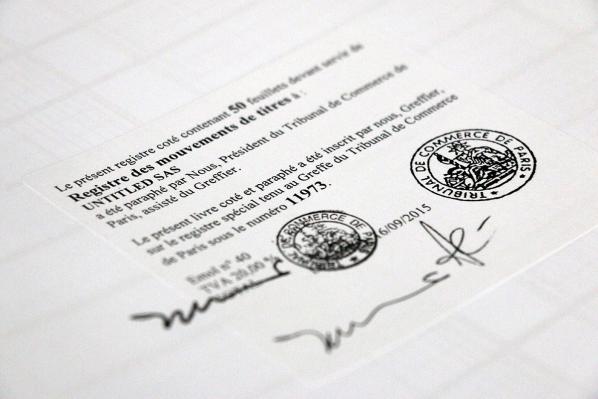

Brout and Marion mount a final probe into questions of value in their piece, Untitled SAS. Untitled SAS is the name for Brout and Marion’s corporation whose purpose and medium is to exist as a work of art. In France SAS means société par actions simplifée, and is the Anglophone equivalent of an LTD. SAS companies have shares that can be freely traded between shareholders. Untitled SAS, in Brout and Marion’s own words, “has no other purpose than to be a work of art: it won’t buy or sell anything, there won’t be employees, its existence is an end it itself. The share capital of the company is 1 Euro (the minimum), and we edited 10,000 shares owned by us (5,000 for each one). Everybody can freely buy and sell shares of this company.” Brout and Marion are clear: in no uncertain terms, “Untitled SAS is a work of art where the medium is a real company, and the corporate purpose of this company is simply to be a work of art.”

Untitled SAS is a tongue in cheek commentary on the situating of artworks as outside of the rational space of the market while still being subject to selective norms of economic behavior. Brout and Marion explain, “Untitled SASis obviously a metaphor for the art market, and the market in general: it is a true, fully legal, and functional speculation bubble. Companies usually try to create some concrete value, they are means. The art world has fewer rules than the regular market, the price of some artworks can radically change in few days without any logical reason: their intrinsic value is completely uncorrelated to their market value. We wanted to reproduce and play with these systems in the scale of an artwork.” At this level, what Brout and Marion uncover is further proof of the condition of the contemporary art period as Groys sees it: a time in which “mass artistic production [follows] an era of mass art consumption” and by extension “means that today’s artist lives and works primarily among art producers—not among art consumers.”7

Crucially, the effect of this condition is that contemporary professional artists “investigate and manifest mass art production, not elitist or mass art consumption.” This is the mode of art making precisely employed by Brout and Marion in the creation of Untitled SAS. It has the added effect, too, of creating an artwork that can exist outside the problem of taste and aesthetic attitude. Companies tend to eschew taste qualifications in favor of brand associations. Untitled SAS becomes readable as an artwork, as Untitled SAS, when the expectations and regulations of a nationally recognized business are made to butt up against the inconsistencies of the artworld as an economic sphere. The art object then becomes rather a means of accessing the overlapping paths of art and value as they are uniquely enabled to circulate in and out of the art & Capitalist markets.

* * *

Brout and Marion note that, “In our work we often use algorithms and generative ways to produce things, but here we wanted to something no machine can do, something hand-made, too, finally a simple and traditional work of art.” These kinds of generative technological processes and sorting algorithms have been central to many debates on how contemporary culture is absorbing the boon of big data: from ethical questions on predictive policing to dating apps and ride-hailing startups. As one Slate article posed the question in relation to Uber, these algorithms are more than just quick and efficient modes of labor—they are reflections of the marketplace themselves.

So what, then, might it mean that both values and services in the digital age are predicated on the power to sort and categorize, and that this power is ciphered through its own dynamic of social relations, but that in one scenario what emerges is a sphere of the valuable and in the other a software that asserts itself as benign and at the behest of an impartial, impersonal data? Perhaps the rationality of value and market circulation vis a vis the art object was always going to be a little too tricky to take on: too many exceptions, too many questions of subjectivity, taste, and judgment. But as the works exhibited for The Human Face of Cryptoeconomies might suggest the rationality of value and the products it chooses to incorporate is of high importance. If value works precisely because of the specific interrelating of social subjects then we can consider the realm of the digital as a concentrated form of such a relation.

Against this we must consider the new subject that is produced and addressed by the intersecting of these discussions. Spaulding and Demby make the case that, that “Art under capitalism is a good model of the freedom that posits the subject as an abstract bundle of legal rights assuring formal equality while ignoring a material reality determined by other forms of systematic inequality.”8 Karen Gregory, in The Datalogical Turn, writes, “In the case of personal data, it is not the details of that data or a single digital trail that are important, it is rather the relationship of the emergent attitudes of digital trails en mass that allow for both the broadly sweeping and the particularised modes of affective measure and control. Big data doesn’t care about ‘you’ so much as the bits of seemingly random information that bodies generate or that they leave as a data trail”.

The works of Brout and Marion exhibited at the Human Face of Crypotoeconomies exhibition places the intimacy of the body front and center. They speak to the shadow and trace of the body by appropriating the paths of the faceless, or by giving a face to the man (or entity) without a body, to becoming the human face of the market player par excellence by inserting themselves into a solipsistic art corporation. Brout and Marion’s practice understands that while value may not be an all-penetrating miasma, this is not also to say that the effect of value is not still inscribed on the flesh of each and all, organic or not.

1 Demby, “Art, Value, and the Freedom Fetish | Mute.”

2 Ibid.

3 Greenberg, “Avant-Garde and Kitsch,” 543.

4 Ibid.

5 Ibid.

6 “Who Is Satoshi Nakamoto?”

7 Groys, “Art and Money.”

8 Ibid.

Plantoid (2015) by Okhaos is a self-creating, self-propagating artwork system that uses blockchain technology to gather and manage the resources it needs to become real and to participate in the artworld. Structured as a Decentralised Autonomous Organization (DAO), once it is set in motion the code of the Plantoid system combines the functions of artwork, artist and art dealer in a single piece of software.

As its name implies, the physical Plantoid artworks are cyborg-looking welded sculptures of flowering plants. Flowers are a popular icon of naturalised aesthetics in art and culture. Their aesthetic and art historical appeal makes them an effective subject for subversion. Radicalized flowers wander through recent art like triffids through the English countryside. Helen Chadwick’s “Piss Flowers” (1991-2) are a proto-xenofeminist riposte to idealisation of nature and the body. Mary Anne Francis’s “The Blooming Commons” (2005) combines the ideas of organic and creative fecundity to help artist and audience consider how making art open source affects its aura. Plantoid can easily be cast in this tradition.

The physical form of Plantoid is determined by its blockchain presence, which represents an advance on the state of the art. The Bitcoin blockchain is a database that represents control of resources. Most simply these resources are amounts of Bitcoin but we can encode information representing other resources – and the right to control them – into the blockchain as well. Current general purpose Bitcoin blockchain-based systems such as Counterparty can easily represent tokens for games, for reward and voucher schemes, or for stocks and shares. Placing these on the blockchain does not magically improve them over existing means of issuing them but it does reduce their barrier to entry and make securing and maintaining them easier. It also defamiliarises them by placing them in a new context and makes them accessible and thereby inspirational to new audiences. Melanie Swan turns this idea up to 11 in her excellent survey of the state of the art and its future potential “Blockchain“, describing the application of the idea of blockchains ultimately to the global economy and even the human mind.

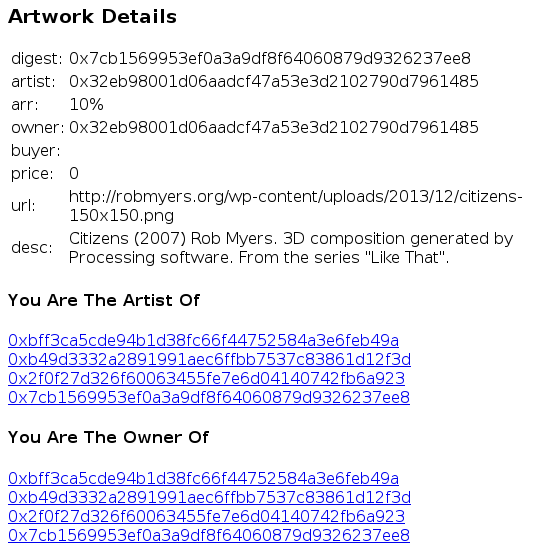

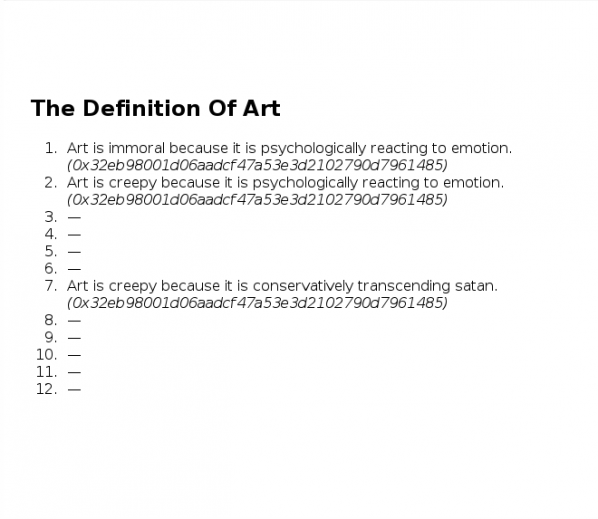

Beyond tokens, the blockchain can be a cheap and effective database of existing property and rights, including recording Free Culture licensing. It is simple to create such a system, I made the first one for artworks based on Ethereum myself. It cannot be an effective means of policing DRM (as DRM is inherently broken) and must not be treated as a means of rolling back the limits of and exceptions to the existing property and copyright regimes or of creating new entitlements ex nihilo. This would turn a technology with great (if contentious) potential for liberation into a tool of exploitation. Making a GIF of Apple’s new emoticons and selling the blockchain title to it for $250 reflects existing social pathologies rather than new technological or artistic affordances.

The technobiophilic machine-nature-form hybrid nature of Plantoid is described by Okhaos in terms that cast cryptocurrency as metabolic and reproductive resources. To quote the project page:

Perhaps the initial Plantoid will need $1000 to fully turn into a blossom. Whenever that particular threshold for the Plantoid is reached, the reproduction process starts: the Plantoid only needs to identify a new person or group of persons (ideally, a group of artists) to create a new version of itself. Given the right conditions, the Plantoid is able to manufacture herself, by executing a smart contract that lives on the blockchain, and has the ability to commission welders, companies, and other beings to build and assemble a similar being.

It’s here that we see how Plantoid represents an advance on existing systems. The parameters of each physical Plantoid are encoded on the Ethereum (rather than the Bitcoin) blockchain as smart contracts, representing the economic and manufacturing logic and the aesthetics of its production as a kind of genome. Plantoid is an active artistic production agent rather than a passive registry of existing art.

The defamiliarising effect of the blockchain allows us to unbundle the collections of rights and responsibilities that make up roles within the mainstream artworld. Paying for the creation of art, its storage and restoration, transport and exhibition. Inspiring, designing, manufacturing, promoting, experiencing, critiquing and art. The artist, the gallerist, the critic, the installer, the attendant. A new territory like the blockchain allows us to shake things up rather than to try to double down on existing relations and distribution of wealth in order to extract new rents.

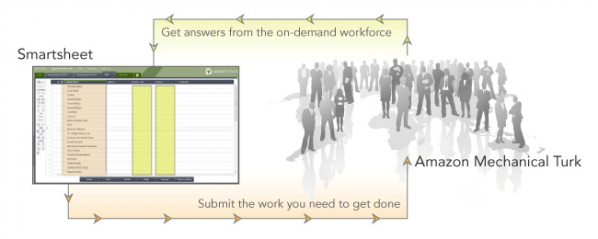

Plantoid opens up the roles of artistic production in precisely this way. It uses the structure of a DAO to incentivise the funding, governance, production, exhibition and reception of Plantoids in a virtuous circle (a positive feedback loop of production). None of this confers ownership or property rights over the physical Plantoid artworks on individual human beings. Their relationships are closer to those of patronage, crowdfunding, or tipping but unbundled further. There are technological precedents for this such as the way Aaron Koblin’s “The Sheep Market” (2008) commissions drawings from clickworkers, Caleb Larsen’s “A Tool To Deceive And Slaughter” (2009) manages its own sale, the way Bitnik’s “Random Darknet Shopper” (2014) orders goods for delivery to the gallery, or Imogen Heap’s release of the single “Tiny Human” (2015) using Ethereum smart contracts

From the project page again:

Plantoids are part of an ecosystem of relationships that is powered by two driving forces: aesthetic beauty and automated governance. Plantoids subtly motivate these interactions, partly through their form and physical beauty, but also by empowering people to participate in their governance. Participants (that is, active members of the DAO) are able to decide on such things as where the Plantoids may be exhibited, whom they might visit, and exactly how they are to be reproduced.

When it receives funds by the audience, the Plantoid evolves and turns into a more beautiful flower, by e.g. moving around a means to gratify the donor and progressively opening up its petals as more and more funds are stored into its wallet. Once enough funds are secured, the Plantoid can use this money to reproduce itself, by commissioning a third party to produce a new Plantoid.

The smart contracts that instantiate these relationships contractually direct human actors to govern the DAO, to manufacture new Plantoids, and to exhibit (and return) the work. The danger of such DAOs is that of any embedded socioeconomic intent – whether corporations, charitable trusts or high frequency trading bots. We may end up with an economic Skynet that reduces us to peons in an algorithmic gig economy, any reflection of our actual needs or desires (such as to make art) perverted by the incentives encoded into an inhuman system. Plantoid exists to ensure the production of art, and its realisation by human artisans. Given the rockstar economics of the artworld and the continued collapse of socioeconomic support for artists outside it that production is badly in need of new means of continuance. The art-economic equivalent of “grey goo” – polychrome goo? – or Terminators armed with spraycans rather than phased plasma rifles seem much less likely scenarios than art DAOs becoming lifeboats or TAZes for the funding of art that is not simply decoration for the 1%. Plantoid’s explicit involvement of human producers in a comradely relationship makes it more a node in the network of collaborative and mutually supportive relationships in the peer economy than an Uberization of artistic production.

Any gap between the ambition and the technology of Plantoid can be crossed by its autopoeitic nature. Ethereum contracts cannot yet manage Bitcoin balances, for example, but using Ethereum’s existing native cryptocurrency “Ether” or one of the proposed systems for managing Bitcoin accounts from Ethereum would address this. Art’s function here, as in its development of religion at the dawn of history, is to create demand for the development of new means of production and relation that a dryly complete rational plan could not reach. Appropriately enough for such a hyperstitional work I discovered it via the blog of renegade philosopher Nick Land.

Without wishing to ventriloquise or reframe its achievements, Plantoid is an exemplary realisation of the potential of mutual interrogation and support of art and cryptocurrency. It’s an art project that uses cryptocurrency and smart contract systems to materially support itself. And that project makes the still abstract potential and operation of cryptocurrency and smart contract tractable to consideration through art. I for one welcome our new hyperstitional DAO artwork overlords.

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Copyright has been a relevant topic since the development of the printing press. It grants the author the exclusive right to reproduce, publish, and sell the content and form of intellectual property. The copy & paste mentality of the Internet user brought chaos to the system. Blockchain technology should now manage the author and marketing rights in a way that is more transparent, completely free of Bitcoin and monetary background. The idea had its origin in the art scene.

The Internet is a space without horizons or frontiers. It has changed our environment and also, thereby, our sensory perception. In ‘the real world’ we are confronted everywhere by people gazing deeply into smartphones: on the street, on the subway, in airplanes, in queues and cafés. Interpersonal dialogue is increasingly being conducted in the virtual sphere. How does the art scene react to new technological developments in arts? I asked Alain Servais (collector), Wolf Lieser (gallerist) and Aram Bartholl (artist.)

AD: Alain, you are collector of digital art since many years. How actively do you use the Internet and the possibilities that it brings for research into art?

AS: I have the opportunity to generally be able to experience art in the real. This is still an indispensable element in the process of acquiring. I’m a big user of the Internet when it’s a question of looking for information on art that’s of interest to me. The key information I always try to gather before acquiring a work is: – a document collating the works which have marked the evolution of the artist’s practice –a piece of writing by an academic, curator or critic contextualizing the artist’s work – an interview with the artist, as I want to hear his/her ‘ voice’ speaking about on his/her art – and a biography.

AD: Wolf, how much do you use the Internet and its possibilities for better marketing in the art scene?WL: We have a presence on various social media and websites, for example, FB, FLICKR, Bpigs, ArtfactsNet, etc. But we try to limit it to those pages that are relevant to art. As an actual communication medium we primarily use Facebook.

AD: Aram, killyourphone.com provides relief and a critique of technology. What would your subjects be without the Internet?

AB: Despite rising levels of communication across devices and networks, I nonetheless notice how, when friends express their opinions on the social media channels, they do so ever more consciously and selectively. We’ve come to understand that all of the commentary and spontaneous utterances on Twitter, FB & co no longer just disappear, but are saved, analyzed and used. ‘Private is the new public’, said Geraldine Juarez recently. The belief that the net makes the world fantastically democratic and offers an equal chance for everyone has, at least since Snowden’s revelations, been finally buried. To that extent, the theme ‘how would it be without the Internet?’ is very interesting! How could we communicate without central, monitoring services? Which low-tech DIY technologies are available in order to exchange data ‘offline’? How can we live without Google?… (A self-test is strongly recommended).

The interplay between the old and new environments leads to numerous uncertainties and generational conflicts. While some nostalgic digital immigrants still assess the advantages of the digital world as being synthetic, alien and unsocial, to the generation of digital natives, the digital abundance is felt as entirely natural. For them, the new technologies were with them in the cradle.

AD: Alain, you are a digital immigrant. What was the first media work in your collection? When did you buy it and why?

AL: My first experience with digital art was with bitforms gallery in NY, more than 10 years ago – at a time when it was really under the radar. I went to an exhibition by Mark Napier from whom I acquired a work at that time – one of the “Old Testament” pieces. That was very natural for me, because I was looking for some new kind of art. I knew enough of art history to know that every important movement in art was always linked to a social, economical, technological, psychological development in society. It was a time, when I was trying to collect works that were really addicted/connected to the actual world, the world around us. I was thinking, ok let’s put myself in 2150: when I’ll be using my third heart and my second brain, what will I say was important in the year 1999/ 2000? Without any doubt it will be the computer and the Internet 2.0 with Facebook and social networks and everything. Eventually I thought: wow people were creating art and it is digital. I immediately considered it to be a very important development for the arts.

AD: Wolf, you procure and sell digital art. What do you think today is the greatest obstacle to understanding the effect of new media?

WL: The sale and procurement via the Internet leads to superficiality. This is, at least, my perception. Experiencing art on a website, interactively or not, is often characterized by shorter cycles/loops compared to viewing the same website here in the gallery. I think we need, as we always did, a balance between the real and the virtual. And actually, this makes sense, because we ourselves do embody both. It’s a reason why the digital natives often express themselves in analog media – it’s no coincidence!

AD: Aram, your works stand at the charged interface between public and private, online and offline, between technological infatuation and everyday life, whereby you teach us how to better understand our new environment. ‘ Whoever sharpens our perception tends to [be] antisocial …’, said media theorist Marshall McLuhan. Is it true?

AB: Especially TODAY it is more important than ever to sharpen perception with regard to the effects of technological development. Two and a half years after Snowden the public discussion on privacy and mass surveillance continues to level off. While the big secret services use their hefty budgets to snow us under, and to lock the doors to the NSA, the interest in further explosive leaks from the Snowden documents is fading. ‘Nothing to hide’ is the mantra of the ‘Smart New World’, in which we can neither see nor sense the complex mechanisms of surveillance. In contrast to the dystopic Matrix scenario, our world will ever be fluffier, smarter and more comfortable, unless one has the wrong passport or sits on a bus next to a presumed terrorist. Then reality will be brutal. Precisely for these reasons it is so important to make the hidden, abstract data world understandable, whether through concrete images, objects, or installations. If you were to hold 8 volumes with 4.7 million passwords of LinkedIn users in your hand hand, you would suddenly understand the significance of the security of our online identities.

Copyright has been a relevant topic since the development of the printing press. It grants the author the exclusive right to reproduce, publish, and sell the content and form of intellectual property. The copy & paste mentality of the Internet user brought chaos to the system. The blockchain technology should now manage the author and marketing rights in a way that is more transparent, completely free of Bitcoin and monetary background. The idea had its origin in the art scene.

AD: Alain, do you think the further development of the blockchain lead to more transparency and protection against forgery?

AS: I would not use the word forgery, but certainly [against] an unfair use of material or a copyright infringement. I suppose that the blockchain is one path that should be investigated and tested for the copyright protection of online works of art. I believe in a transformation of the economy of the market for online art towards the direction of a wider distribution through, perhaps, a ‘renting’ of the work rather than an illusory acquisition (taking into account the copyright stays with the artist anyway). i-tunes and Spotify both adapted well to the online art economy.

AD: Wolf, do you make use of these new possibilities within the marketing of digital art? And have you already thought about a new currency model?

WL: I’ve already been confronted by this and I think that it makes sense. With my artists though there’s as yet no need or willingness. I’ve yet to engage with new currency models.

AD: Aram, to what extent is the blockchain and Bitcoin really discussed within artist circles?

AB: Services like Wikipedia, the Open-Source Software movement and, in principle, the entire World Wide Web wouldn’t exist at all today had Telco-payment-services pushed through its fee-based BTX/videotext with pay-per-view, in the 1980s. Naturally the possibility turns the never-ending reproduction of classic markets on its head, and in recent years, there have been extensive debates about copyright and intellectual property. We shouldn’t forget though, that a large part of the software that operates the Internet and millions of devices came about in the spirit of the sharing-culture. The blockchain is a powerful tool, which introduces a form of artificial scarcity into the digital environment. It’s up to each artist himself or herself whether and how he or she chooses to distribute their work. The art market and the demand will certainly create some model or other for the sale and distribution of art that only exists in bits and bytes. Let’s wait and see…

Many of both Bitcoin’s most vocal proponents and detractors agree that the way the cryptocurrency operates technologically determines the form of the economy and therefore the society that uses it. That society would be anarcho-capitalist, lacking state institutions (anarcho-) but enforcing commodity property law (capitalist). If this is true then Bitcoin has the potential to achieve a far greater political effect than financial engineering efforts like the Euro or quantitative easing and with far fewer resources. Perhaps variations on this technology can create alternatives to Bitcoin that determine or at least afford different socioeconomic orders.

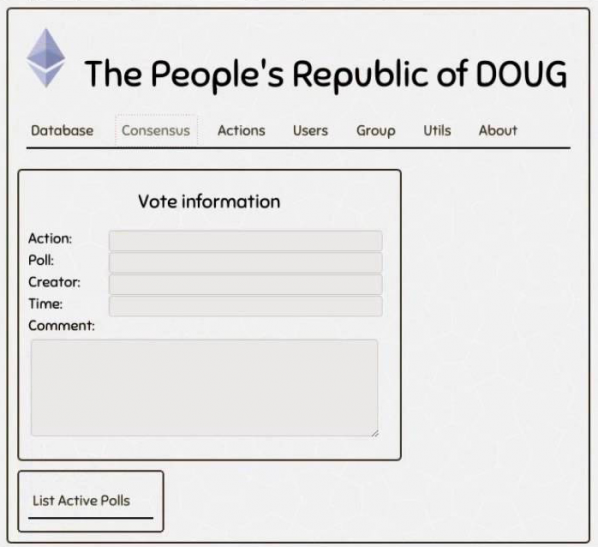

Bitcoin is already more than half a decade old and “Crypto 2.0” systems that build on its underlying blockchain technology (the blockchain is a network-wide shared database built by consensus, Bitcoin uses it for its ledger) are starting to emerge. The most advanced allow the creation of entire organizations and systems of organization on the blockchain, as Decentralized Autonomous Organizations (DAOs). We can use them to help create those different socioeconomic orders.

Workers’ Councils are a Liberatarian Socialist system of organization. Rather than implementing Soviet-style centralized command economies, workers councils are decentralized and democratic. Workers in a particular workplace decide what their objectives are then appoint temporary (and instantly revocable) delegates to be responsible for them. Workplaces appoint representatives to local councils, local councils appoint representatives to regional councils, and so on, always temporarily and revocably. It is a system of face to face socialisation and political representation rather than top-down control.

This system emerged at various times in Europe, South America and the Middle East throughout the Twentieth Century. It is a very human method of governance, in stark contrast to the “trustless” code of Bitcoin as well as to the centralized politics of the Soviets. That said, technology can assist organization as easily as it can support material production. In the 1970s the cordones of Chile interfaced with the Allende government’s Project Cybersyn network, and contemporary online workers collectives can use the Internet to co-ordinate.

A DAO is a blockchain-based program that implements an organization’s governance and controls its resources using code rather than law. There can be a fetishistic quality to the idea of cold, hard, unyielding software perfect in its unambiguous transparency and incapable of human failing in its decision making. There can be similar fetishistic qualities to legal and political organizational perfectionism, this doesn’t disqualify any of their subjects as useful ideals however they need to be tempered pragmatically.

Using the public code and records of a DAO can help with the well known problem of structurelessness, and can store information more efficiently and reliably than a human being with a pen and paper. The much vaunted trustlessness of cryptovurrency and smart contract systems can help build trust in communication within and between groups – cryptographically signed minutes are relatively hard to forge although the ambiguity of language is impossible to avoid even in the mathematics of software.

The delegates of a workers’ council can be efficiently and transparently voted on, identified by, and recalled using a DAO. This makes even more sense for distributed groups of workers, groups that share a common cause but lack a geographic centre. Delegates can even be implemented as smart contracts, code written to control resource allocation and evaluate performance in the pursuit of their objective (unless recalled by the council that created them).

Entire councils, and inter-council organisation, can be supported or implemented in their organization as DAOs. Support includes communication and record keeping. Implementation included control of resources, running delegates as code, and even setting objectives for delegates programatically.

The latter finally brings the concept of DAOs into direct conflict with the spirit of the Workers’ Council. Councils exist to allow individual human beings to express and agree on their objectives, not to have them imposed from above. Being controlled by code is no better than political or economic control. It is the nature of this relationship to code, politics or the economy that is positive or negative – writing code to charge someone or something with seeing that a task be undertaken is no different from writing it in the minutes and makes mroe explicit that organization is production as the subject of work in itself. A democratic, recallable DAO that sets objectives is very different from a blob of capital with unchangeable orders to maximise its profits online.

The resources that a DAO controls need not be monetary (or tokenized). A DAO that controls access to property, energy or other resources can contribute to avoiding the pricing problem that conventional economics regarded as a showstopper for the Soviet cybernetic economic planning of “Red Plenty“. DAOs need not even be created to represent human organization – “deodands” can represent environmental commons as economic actors. These can then interact with workers council DAOs, representing environmental factors as social and economic peers and avoiding the neoliberal economic problems both of externalities and privatisation.

Workers Council DAOs – Decentralized Autonomous Workers Councils (DAWCs) are science fiction, but only just. Workers councils have existed and been plugged in to the network, structurelessnes and scalability are problems, DAOs exist and can help with this. Simply tokenizing “sharing economy” (actually rentier economy) forms, for example replacing Uber’s taxi sharing with La’zooz, while maintaining the exploitative logic of disintermediation isn’t enough.

If we are unable or unwilling to accelerate the social and productive forces of technology to take us to the moon, we can at least embrace and extend them in a more human direction.

The text of this article is licenced under the Creative Commons BY-SA 4.0 Licence.

LAB #2 in the Art Data Money series

A weekend workshop, led by Dan Hassan of the Robin Hood Cooperative, focusing on the political/social relevance of Bitcoin, blockchains, and finance. All participants will be given some Bitcoin.

ADMISSION FEE: £10 for one day or £15 for the weekend*

The weekend workshop will take a historical look at the political / social relevance of Bitcoin (“Breaking the Taboo on Money”) by looking at the history of technical and social inventions the came before it. I’ll then futurecast what this could mean for the future of p2p finance (blockchains, new social architectures and peer owned platforms with a mix of synthetic finance, peer-owned-banks) and place Robin Hood Coop within this future (“Breaking the Taboo of Financial Markets”).

It will include hands on activities on covering topics such as blockchains (actually running them and understanding them) as well as dissecting financial instruments – such as Robin Hood Cooperative has been doing.

Day 1 – Breaking the Taboo on Money (focus on Bitcoin and blockchain):

11.00 Group introductions

11.30 Bitcoin, blockchains, finance – a series of quick 5 minute 101 introductions

11.30 – 13.00 Using Bitcoins whilst expanding our understanding of why this is so groundbreaking

13.00 – 13.30 Lunch

13.30 – 14.00 Recap

14.00 – 17.00 (with tea breaks) tbc

Day 2 – Breaking the Taboo on Financial Markets (focus on Robin Hood’s activities on Wall Street):

11.00 Group introductions

11.30 Bitcoin, blockchains, finance – a series of quick 5 minute one-to-one introductions (+ quick recap from the previous days session).

11.30 – 13.00 Emergent workshop from constellation of interests of those who turn up

13.00 – 13.30 Lunch

13.30 – 14.00 Recap

14.00 – 17.00 (with tea breaks) tbc

Part of Furtherfield’s Art Data Money programme.

– If you can’t afford the entry price, get in touch anyway and we can figure something out.

– All participants will be given some Bitcoin

– The workshop runs across two days. Both days will be complementary, but will also be standalone. there won’t be too much duplication for those who attend both, but you won’t be left behind if you only attend one.

Pre-reading / listening: Listen to as much of this talk by Vinay Gupta as you can.

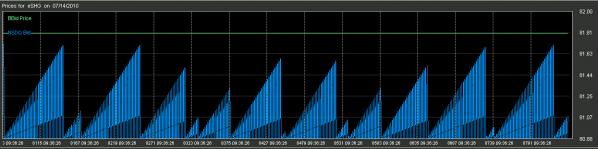

Robin Hood Asset Management Cooperative is a cooperative owned and run by its members. At the moment we have over 500 members from 15 different countries and together we manage assets of about half a million euros. In the two years we have been active, we have created over 100,000 euros to our members and to our common pool. We disrupt the ordinary flows of money, share the loot, and invest the profits in the production and protection of commons.

More info: http://robinhoodcoop.org/

Dan Hassan (UK) is a computer engineer active in autonomous co-operatives over the last decade; in areas of economics (Robin Hood), housing (Radical Routes), migration (No Borders) and labour (Footprint Workers). He tweets as @dan_mi_sun

Featured image: Aram Bartholl, Forgot Your Password?, 2013

Historical art is developed by way of its respective era and society, meaning that it is always made in the present. Today, new technologies open up new possibilities for artistic potential. Currently, art production, which is influenced by new technologies, is reacting strongly to the changing times. Artworks are being created, which react to digitalisation, even if they don’t necessarily reflect the digital format itself (i.e. like works by Aram Bartholl).

In its purest form, digital art is ephemeral and based on a transient technology. The continual advancement of the technology demands on-going improvements; challenges from which many emerging artists refuse to be deterred. On the contrary: the monthly quota of events related to digital art proves the high level of interest around the form.

The global technical networks thereby bring about new atmospheres, or perhaps, infospheres, as media theorist Peter Weibel calls them. In the art world, previously held art-historical considerations are forced towards a re-evaluation. Conventional theories and practices must be called into question. New art forms in the immaterial digital domain demand a general rethink in terms of their conservation, presentation and acquisition. And, of course, the reception of digital art is also different.

According to studies by Hiscox, a preference for original works still dominates both in conventional and online trade. Authenticity and intrinsic value continue to be important criteria when it comes to decision-making regarding the purchase of art. Transparency will remain, for the long term, a fundamental prerequisite for the establishment of trust.

Most acquisitions of digital art take place conventionally by way of galleries. If a collector acquires, for example, a website, then the gallerist sells he or she a domain (which is unique!) and transfers in-addition, a licence contract. This is a material document. The ‘network’ remains virtual, while retaining open all of the attributes of an artwork in the source code, i.e. the artist’s signature, the title, the year in which it was produced, the technique, and information on the programmer or the collector.

The collector can enjoy the work beyond the confines of time and physical location. Simultaneously, he or she is responsible for its preservation, which is the guarantee for the continuation of its existence over time.

Internet art in general is dependant on software, but above all it relies on hardware (computer, hard-drive, interfaces, sensors, monitors, projectors, etc.). Yet for how long will the hardware remain a part of our interactive culture? Forward-looking collectors purchase, in addition to the contract, a series of devices that safeguard the work for the future.

The ability to learn about new approaches in our fast-moving culture occurs both naturally and dynamically. The art market is an extremely non-transparent market, access to the right networks and contacts. Is this likely to change any time soon?

Art history shows us that artists are ahead of their time, anticipating what is to come. One need only cast an eye around the scene, in order to open the door to new ideas and technological marketing methods in the art world.

The German artist, Stephan Vogler, has already done this and in cooperation with a law firm has unleashed intelligent synergies. The artist himself produces digital files – intangible goods, as he calls them – which should also naturally migrate to the art market over the long-term, in the best case scenario, as unique pieces which one – such is the thinking within his system – can acquire with Bitcoin.

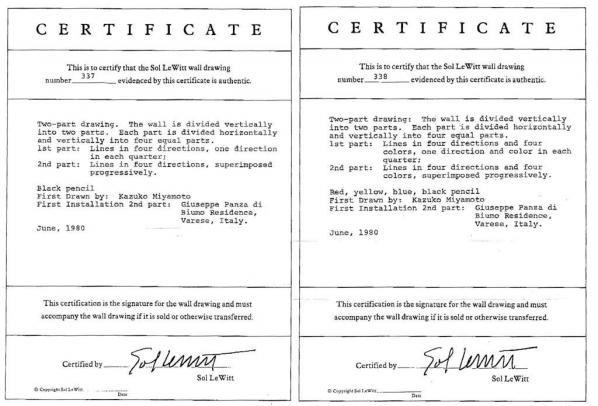

Far more interesting than the means of purchase, is the Bitcoin technology that lies behind it.

Stephan Vogler has developed a licence together with experts on legal practice within the art world, which transforms the digital artwork into an independently tradable virtual commodity, which is limited, both in terms of its technology and its legal rights. The system is based on a license agreement under the utilization of the Bitcoin technology. All works will come with an electronic signature, which is recognized, in legal terms, as being an original signature. This also serves as proof that the files existed at a given moment in time. Their authenticity is mathematically verifiable and the right of resale is exclusive. Virtual ownership is technically and legally limited to the respective owner. The owner of the usage rights is registered in a decentralized Bitcoin Blockchain, and the rights regarding the work are assigned through a Bitcoin transaction. In this way, digital artworks become both tradable and collectable objects without the requirement of their materialisation. Purchase and transaction take place simultaneously and the function of the custodian is eliminated. The structure behind the acquisition is thereby extremely transparent.

Artists like Stephan Vogler want to revolutionize the market for digital art through new technology. But independent from this fact, the art world is not sleeping. Collectors, institutions and art market platforms are already taking note.

For example, Austria’s Museum for Modern Art (MAK) has already bought an artwork with Bitcoin.

Cointemporary.com, a curated online platform, offers ephemeral artworks at a fixed Bitcoin (BTC) price – independent from the actual exchange rate. Berlin company ascribe.io develops systems within the Blockchain technology and offers services for art experts, assisting in the professional management of their digital files, i.e. their registration, archival, transfer of ownership etc.

The Winklevoss twins are known as great advocates of the digital currency. Rumours about investments in the art form are rife.

The acquisition of artworks via Bitcoin sounds forward-looking and simple yet should be enjoyed with a good degree of care. The reason for this is that Bitcoin is not controlled by a state and its central bank, but rather is generated by Internet users by way of complicated arithmetic calculations. So what might be the advantage of a Bitcoin purchase?

Collectors of digital art, such as the Belgian, Alain Servais, or Hampus Lindwall, from Sweden, view the purchase of work via the risky Bitcoin currency with scepticism.

It is still too early to really be able to judge the effects of these developments. Ultimately, the discussion as a whole concentrates far less on the system of currency than on the technology itself, which can also be applied to other circumstances. These experiments will only truly bear fruit through the development of a high degree of know-how, the courage to take on legal consequences at the moment of purchase, and through simple decisions in a user-friendly design.

Featured image: Image “earth” by Beth Scupham https://goo.gl/ZMBzuw (Creative Commons Attribution)

Brett Scott is the author of The Heretic’s Guide to Global Finance: Hacking the Future of Money (Pluto Press: 2013). And writes for various publications, including The Guardian, Wired Mag and New Scientist, and commentate on issues like financial reform, cryptocurrency and peer-to-peer systems. he is also involved in projects related to alternative finance, financial activism, and economic justice, such as Action Aid, World Development Movement, Open Oil, The Finance Innovation Lab, and MoveYourMoney UK.

In Kim Stanley Robinson’s epic 1993 sci-fi novel Red Mars, a pioneering group of scientists establish a colony on Mars. Some imagine it as a chance for a new life, run on entirely different principles from the chaotic Earth. Over time, though, the illusion is shattered as multinational corporations operating under the banner of governments move in, viewing Mars as nothing but an extension to business-as-usual.

It is a story that undoubtedly resonates with some members of the Bitcoin community. The vision of a free-floating digital cryptocurrency economy, divorced from the politics of colossal banks and aggressive governments, is under threat. Take, for example, the purists at Dark Wallet, accusing the Bitcoin Foundation of selling out to the regulators and the likes of the Winklevoss Twins.

Bitcoin sometimes appears akin to an illegal immigrant, trying to decide whether to seek out a rebellious existence in the black-market economy, or whether to don the slick clothes of the Silicon Valley establishment. The latter position – involving publicly accepting regulation and tax whilst privately lobbying against it – is obviously more acceptable and familiar to authorities.

Of course, any new scene is prone to developing internal echo chambers that amplify both commonalities and differences. While questions regarding Bitcoin’s regulatory status lead hyped-up cryptocurrency evangelists to engage in intense sectarian debates, to many onlookers Bitcoin is just a passing curiosity, a damp squib that will eventually suffer an ignoble death by media boredom. It is a mistake to believe that, though. The core innovation of Bitcoin is not going away, and it is deeper than currency.

What has been introduced to the world is a method to create decentralised peer-validated time-stamped ledgers. That is a fancy way of saying it is a method for bypassing the use of centralised officials in recording stuff. Such officials are pervasive in society, from a bank that records electronic transactions between me and my landlord, to patent officers that record the date of new innovations, to parliamentary registers noting the passing of new legislative acts.

The most visible use of this technical accomplishment is in the realm of currency, though, so it is worth briefly explaining the basics of Bitcoin in order to understand the political visions being unleashed as a result of it.

Banks are information intermediaries. Gone are the days of the merchant dumping a hoard of physical gold into the vaults for safekeeping. Nowadays, if you have ‘£350 in the bank’, it merely means the bank has recorded that for you in their data centre, on a database that has your account number and a corresponding entry saying ‘350’ next to it. If you want to pay someone electronically, you essentially send a message to your bank, identifying yourself via a pin or card number, asking them to change that entry in their database and to inform the recipient’s bank to do the same with the recipient’s account.

Thus, commercial banks collectively act as a cartel controlling the recording of transaction data, and it is via this process that they keep score of ‘how much money’ we have. To create a secure electronic currency system that does not rely on these banks thus requires three interacting elements. Firstly, one needs to replace the private databases that are controlled by them. Secondly, one needs to provide a way for people to change the information on that database (‘move money around’). Thirdly, one needs to convince people that the units being moved around are worth something.

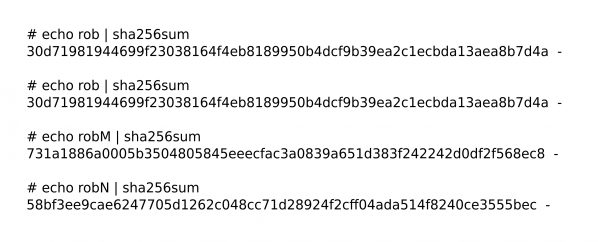

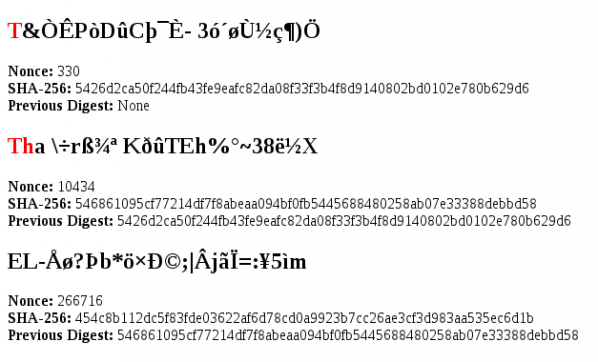

To solve the first element, Bitcoin provides a public database, or ledger, that is referred to reverently as the blockchain. There is a way for people to submit information for recording in the ledger, but once it gets recorded, it cannot be edited in hindsight. If you’ve heard about bitcoin ‘mining’ (using ‘hashing algorithms’), that is what that is all about. A scattered collective of mercenary clerks essentially hire their computers out to collectively maintain the ledger, baking (or weaving) transaction records into it.

Secondly, Bitcoin has a process for individuals to identify themselves in order to submit transactions to those clerks to be recorded on that ledger. That is where public-key cryptography comes in. I have a public Bitcoin address (somewhat akin to my account number at a bank) and I then control that public address with a private key (a bit like I use my private pin number to associate myself with my bank account). This is what provides anonymity.

The result of these two elements, when put together, is the ability for anonymous individuals to record transactions between their bitcoin accounts on a database that is held and secured by a decentralised network of techno-clerks (‘miners’). As for the third element – convincing people that the units being transacted are worth something – that is a more subtle question entirely that I will not address here.

Note the immediate political implications. Within the Bitcoin system, a set of powerful central intermediaries (the cartel of commercial banks, connected together via the central bank, underwritten by government), gets replaced with a more diffuse network intermediary, apparently controlled by no-one in particular.