French artists Émilie Brout and Maxime Marion contribute three pieces to The Human Face of Cryptoeconomies exhibition. Gold and Glitter is a painstakingly assembled installation of collaged GIFs. Previous installations have featured the GIFs displayed on a gold iPad atop a pile of collected gold trinkets; at Furtherfield Gallery now a single golden helium balloon hovers in front of a floor to ceiling projection. Nakamoto (The Proof) is video documentation of the artists’ efforts to try and place a face on the elusive Bitcoin creator, Satoshi Nakamoto (but is it his face in the end? We don’t know). Untitled SAS is a registered French company without employees and whose sole purpose is to exist as a work of art.

Brout and Marion’s work can be situated among artists and art practices who have grappled with how to think about value and objects—or more precisely, how objects are inscribed (and sometimes not) into an idea of what is valuable. In a recent article for Mute Magazine, authors Daniel Spaulding and Nicole Demby point out that “Value is a specific social relation that causes the products of labor to appear and to exchange as equivalents; it is not an all-penetrating miasma.”1 Value is a process by which bodies are sorted and edited but it is not a default spectrum on to which all bodies must fall in varying degrees. This clarification makes explicit the fact that while the relationships productive of value allow “products of labor to appear and to [be exchanged]”2 this is not an effect that is extended to all products of labor. Attempts to isolate the underlying logic of this sorting mechanism are often at the heart of art practices dealing with questions of value and commodification. Like Andy Warhol’s Brillo Boxes or Marcel Duchamp’s Fountain, these artworks become interesting problematics for the question of art and value for the ways in which they are able to straddle two economic realms—that of the art object and the commercial object—while resisting total inclusion in either.

The Human Face of Cryptoeconomies picks up these themes in an art context and repositions them alongside digital cultures and emerging digital economies. In Brout and Marion’s work alone, concepts of kitsch, identity, and human capital have been inhabited and imported from their originary realms into the digital. Answering questions remotely, Brout and Marion were kind enough to give us some insights into their work and process. My goal here has been to draw out some points about the operation of value that are at work in Brout and Marion’s practice, as well as to point towards an idea of how value is transformed, or even mutated, in the digital age.

* * *

Brout and Marion open up with an interesting provocation. They explain, “When we showed the project [Glitter and Gold] in Paris this year, people stole a lot of objects, even if they were very cheap. Gold has an incredible power of attraction.”

It is telling, to some extent, that Brout and Marion’s meditations on gold have an almost direct link to the visual metaphor used by Clement Greenberg in his 1939 essay Avante-Garde and Kitsch to describe the relation between culture—epitomized in the avant-garde—and the ruling class. Greenberg writes, “No culture can develop without a social basis, without a source of stable income. And in the case of the avant-garde, this was provided by an elite among the ruling class of that society from which it assumed itself to be cut off, but to which it has always remained attached by an umbilical cord of gold.”3 This relation is subverted in Gold and Glitter, which takes for its currency—its umbilical cord of gold—a kind of unquantifiable labor that is seemingly (and perhaps somewhat sinisterly) always embedded in discussions of the digital.

For Greenberg, kitsch always existed in relation to the avant-garde; one fed and supported the other, even if the way in which that relation of sustenance worked was by negation. And while Greenberg’s theory relies on his own strict allegiances to hierarchical society, privileged classes, the values of private property, and all the other divisive tenets of capitalism that we now know all too well can be destructive. Kitsch remains useful to us for the ways in which it allows the means of production to enter into a consideration of aesthetics. Here the recent writing of Boris Groys can be useful. In an essay written for e-flux titled Art and Money, Groys makes a compelling case for why we should persist in a sympathetic reading of Greenberg. He argues that Greenberg’s incisions amongst the haves and have nots of culture can be cut across different lines; that because Greenberg identifies avant-garde art as art that is invested in demonstrating the way in which is it is made and it doesn’t allow for its evaluation by taste. Avant-garde art shows its guts to us all, and on equal terms—“its productive side, its poetics, the devices and practices that bring it into being” and inasmuch “should be analyzed according the same criteria as objects like cars, trains, or planes.”4

For Groys this distinction situates the avant-garde within a constructivist and productivist context, opening up artworks themselves to be appreciated for their production, or rather, “in terms that refer more to the activities of scientists and workers than to the lifestyle of the leisure class.”5 In this way Glitter and Gold, like Brout and Marion’s other artworks, is to be appreciated not for any transcendent reason but rather for the means by which it came into existence. ‘The processes of searching and collaging golden GIFs sit side by side with the physical work of accumulating the golden trinkets for display: “We collected these objects for a long time” the artists explain, “some were personal objects (child dolphin pendant, in true gold), others were given or found in flea markets, bought in bazaars … We wanted to have a lot of different types and symbols, from a Hand of Fatima to golden chain, skulls, butterflies, etc.”

Furthermore, Glitter and Gold can be understood as the product of compounding labors: the labor of Brout and Marion in collecting their artifacts, the labor necessary to create the artifacts, the labor of GIF artists, the labor of searching for said GIFs, the labor of weaving a digital collage. These on-going processes forge, trace, and re-trace paths during which, at some point, gold takes on the function as aesthetic shorthand for value. As Brout and Marion explain, “Here the question is more about the intrinsic values we all find in Gold, even when it just looks like gold. Gold turns any prosaic product into something desirable. [Gold and Glitter] is less about economics than about perceived value.”

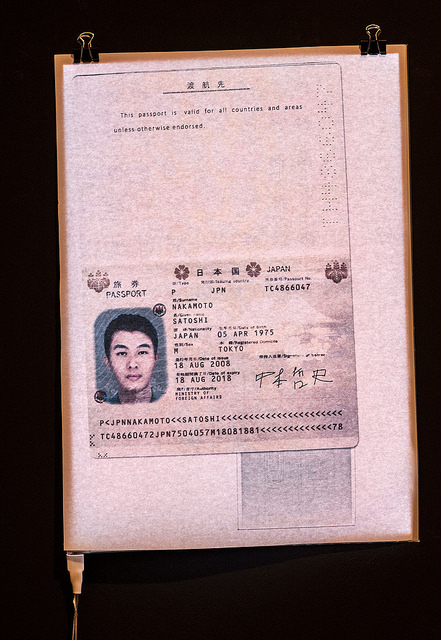

Groys provides his reading of Greenberg as a means of pointing towards a materiality that is always in excess of existing coordinates of value. If value always reveals the products of labor as they enter into a zone of exchange, it is something else proper to contemporary art that reveals another materiality beyond this exchange. For Groys, this something else is at work in the dynamics of art exhibition, which can render visible otherwise invisible forces and their material substrates. This is certainly a potential that is explored by Brout and Marion. In Nakamoto (The Proof), the viewer can watch the artists’ attempt at creating a passport for the infamous and elusive Bitcoin creator Satoshi Nakamoto. At present, it is unclear whether Nakamoto is a single person or group of people, though the Nakamoto legacy as creator of Bitcoin, a virtual currency widely used on darknets, is larger than life. Adding to this myth, after publishing the paper to kickstart bitcoin via the Cryptography Mailing List in 2008, and launching the Bitcoin software client in 2009, Nakamoto has only sporadically been seen participating in the project with others via mailing lists before making a final, formal disappearance in 2011, explaining that he/she/they had “moved on to other things.”6 Nakamoto’s disappearance, coupled with the fact that Nakamoto’s estimated net worth must be somewhere in the hundred millions Euros, has given rise to the modern-day myth of Nakamoto, and with it an insatiable curiosity to uncover the identity and whereabouts of the elusive Bitcoin creator.

Brout and Marion make their own attempt to summons the mysterious Nakamoto back to life by putting together the evidence of Nakamoto’s existence and procuring a Japanese passport using none other than the technologies that Nakamoto’s Bitcoin both imparted and facilitated. When asked if they feared for their own self-preservation in seeing this project through, Brout and Marion answered, “Yes, even if we were pretty sure that it would be easy to prove our intention to the authorities, and that the fake passport couldn’t be useful to anybody, buying a fake passport is still illegal.” They add, “But we also wanted to play the game entirely, so we made every possible effort to preserve our anonymity during our journey on the darknets.”

However Brout and Marion have yet to receive the passport; as they explain, “The last time we received information, the document was in transit at the Romanian border.” When asked if they expect to receive the passport, they respond, “No, today we think we will never receive it. We are completely sure that it has existed, but we’ll surely never know what happened to it.” What, then, will they do if they never receive the passport? “Maybe just continue to exhibit the only proof of it we have!” they exclaim. “There is something beautiful in it: we tried to create a physical proof of the existence of a contemporary myth, using digital technology and digital money, and the only thing we have is a scan!”

If Brout and Marion’s nonchalance seems unexpected then it is because the disappearance of the passport for the artists marks just another ebb in the overall flow of their piece; a flow that began with Nakamoto, coursed through their clandestine chats via a Tor networked browser and high security email, and now continues to trickle on while we wait in anticipation for the next chapter of the Nakamoto passport to reveal itself. In this respect, the anticipation of the passport is a poetic and unforeseen layer added to the significance of the piece: “Maybe it is even better [that the passport should not arrive]” Brout and Marion comment. “It’s like it was impossible to bring Nakamoto out of the digital world.”

If value is always formed by way of a social relation, then how do digital modes of sociality also deliver this effect? This becomes a particularly fraught question when considering that, as Anna Munster has written, the sociality that takes place on the internet can be understood as the interrelation of any number of subjectivities, both organic and inorganic. Brout and Marion’s ambivalence to the purloined passport highlights just such an expectation: “Here the lack of identity delivers a lot of value. Look at Snowden: journalists ask him more about his girlfriend than about his revelations. Making something as big as Bitcoin and staying perfectly anonymous? These are strong attacks to two of the most important issues of our societies: banks and privacy.” What their statement suggests is how a collective movement towards transgression, here seen as compounding maneuvers of avoidance of physical world boundaries and institutions, might hold within it the promise of its own set of value coordinates. As Brout and Marion further explain: “For us, Nakamoto is absolutely fascinating. The efforts he made to prevent himself from being turned into a product are incredible. Especially when you know the importance of [Bitcoin’s] creation, and that only a few men in the world are smart enough to create something like this. Adding to that the fact that Nakamoto is probably a millionaire, you have one of the only true contemporary myths, something hard to find credible even if it was just a fictional character in a movie. So this somewhat absurd attempt to create a proof of Nakamoto’s existence was, for us, an attempt to make a portrait of him, to put light on his figure. And, in some ways, a tribute.”

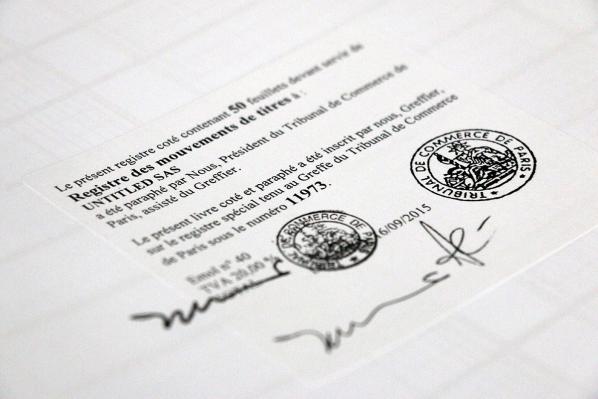

Brout and Marion mount a final probe into questions of value in their piece, Untitled SAS. Untitled SAS is the name for Brout and Marion’s corporation whose purpose and medium is to exist as a work of art. In France SAS means société par actions simplifée, and is the Anglophone equivalent of an LTD. SAS companies have shares that can be freely traded between shareholders. Untitled SAS, in Brout and Marion’s own words, “has no other purpose than to be a work of art: it won’t buy or sell anything, there won’t be employees, its existence is an end it itself. The share capital of the company is 1 Euro (the minimum), and we edited 10,000 shares owned by us (5,000 for each one). Everybody can freely buy and sell shares of this company.” Brout and Marion are clear: in no uncertain terms, “Untitled SAS is a work of art where the medium is a real company, and the corporate purpose of this company is simply to be a work of art.”

Untitled SAS is a tongue in cheek commentary on the situating of artworks as outside of the rational space of the market while still being subject to selective norms of economic behavior. Brout and Marion explain, “Untitled SASis obviously a metaphor for the art market, and the market in general: it is a true, fully legal, and functional speculation bubble. Companies usually try to create some concrete value, they are means. The art world has fewer rules than the regular market, the price of some artworks can radically change in few days without any logical reason: their intrinsic value is completely uncorrelated to their market value. We wanted to reproduce and play with these systems in the scale of an artwork.” At this level, what Brout and Marion uncover is further proof of the condition of the contemporary art period as Groys sees it: a time in which “mass artistic production [follows] an era of mass art consumption” and by extension “means that today’s artist lives and works primarily among art producers—not among art consumers.”7

Crucially, the effect of this condition is that contemporary professional artists “investigate and manifest mass art production, not elitist or mass art consumption.” This is the mode of art making precisely employed by Brout and Marion in the creation of Untitled SAS. It has the added effect, too, of creating an artwork that can exist outside the problem of taste and aesthetic attitude. Companies tend to eschew taste qualifications in favor of brand associations. Untitled SAS becomes readable as an artwork, as Untitled SAS, when the expectations and regulations of a nationally recognized business are made to butt up against the inconsistencies of the artworld as an economic sphere. The art object then becomes rather a means of accessing the overlapping paths of art and value as they are uniquely enabled to circulate in and out of the art & Capitalist markets.

* * *

Brout and Marion note that, “In our work we often use algorithms and generative ways to produce things, but here we wanted to something no machine can do, something hand-made, too, finally a simple and traditional work of art.” These kinds of generative technological processes and sorting algorithms have been central to many debates on how contemporary culture is absorbing the boon of big data: from ethical questions on predictive policing to dating apps and ride-hailing startups. As one Slate article posed the question in relation to Uber, these algorithms are more than just quick and efficient modes of labor—they are reflections of the marketplace themselves.

So what, then, might it mean that both values and services in the digital age are predicated on the power to sort and categorize, and that this power is ciphered through its own dynamic of social relations, but that in one scenario what emerges is a sphere of the valuable and in the other a software that asserts itself as benign and at the behest of an impartial, impersonal data? Perhaps the rationality of value and market circulation vis a vis the art object was always going to be a little too tricky to take on: too many exceptions, too many questions of subjectivity, taste, and judgment. But as the works exhibited for The Human Face of Cryptoeconomies might suggest the rationality of value and the products it chooses to incorporate is of high importance. If value works precisely because of the specific interrelating of social subjects then we can consider the realm of the digital as a concentrated form of such a relation.

Against this we must consider the new subject that is produced and addressed by the intersecting of these discussions. Spaulding and Demby make the case that, that “Art under capitalism is a good model of the freedom that posits the subject as an abstract bundle of legal rights assuring formal equality while ignoring a material reality determined by other forms of systematic inequality.”8 Karen Gregory, in The Datalogical Turn, writes, “In the case of personal data, it is not the details of that data or a single digital trail that are important, it is rather the relationship of the emergent attitudes of digital trails en mass that allow for both the broadly sweeping and the particularised modes of affective measure and control. Big data doesn’t care about ‘you’ so much as the bits of seemingly random information that bodies generate or that they leave as a data trail”.

The works of Brout and Marion exhibited at the Human Face of Crypotoeconomies exhibition places the intimacy of the body front and center. They speak to the shadow and trace of the body by appropriating the paths of the faceless, or by giving a face to the man (or entity) without a body, to becoming the human face of the market player par excellence by inserting themselves into a solipsistic art corporation. Brout and Marion’s practice understands that while value may not be an all-penetrating miasma, this is not also to say that the effect of value is not still inscribed on the flesh of each and all, organic or not.

1 Demby, “Art, Value, and the Freedom Fetish | Mute.”

2 Ibid.

3 Greenberg, “Avant-Garde and Kitsch,” 543.

4 Ibid.

5 Ibid.

6 “Who Is Satoshi Nakamoto?”

7 Groys, “Art and Money.”

8 Ibid.